-

Your trusted market research partner

- info@theindiawatch.com

- 8076704267

Can India become the Seed Bowl of the World?

The Indian seed industry is valued at ~ 2.7 billion, which makes it one of the largest seed markets in the .....

- July 22, 2021

- Posted by: Admin

- Categories: Manufacturing Sector

Can India become the Seed Bowl of the World?

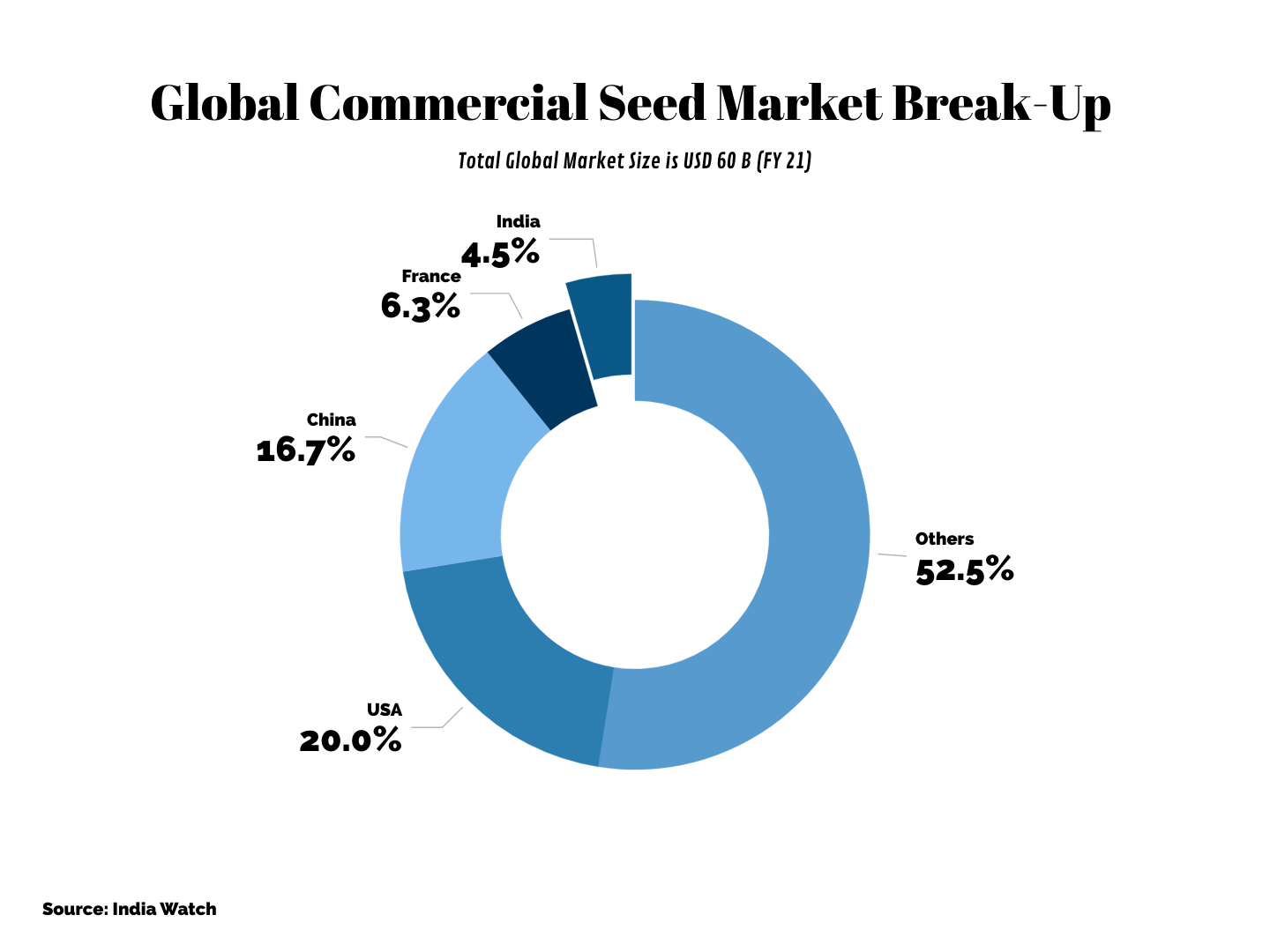

The Indian seed industry is valued at ~ 2.7 billion, which makes it one of the largest seed markets in the world, after the USA (USD 12 B), China (USD 10 B), France (USD 3.75), etc. The global seed market size is around USD 60 billion and is run by a host of entities- seed breeding & R&D companies, individual breeders, seed arms of agrochemical companies, seed marketing companies, public sector entities, agricultural cooperatives & associations, and much more.

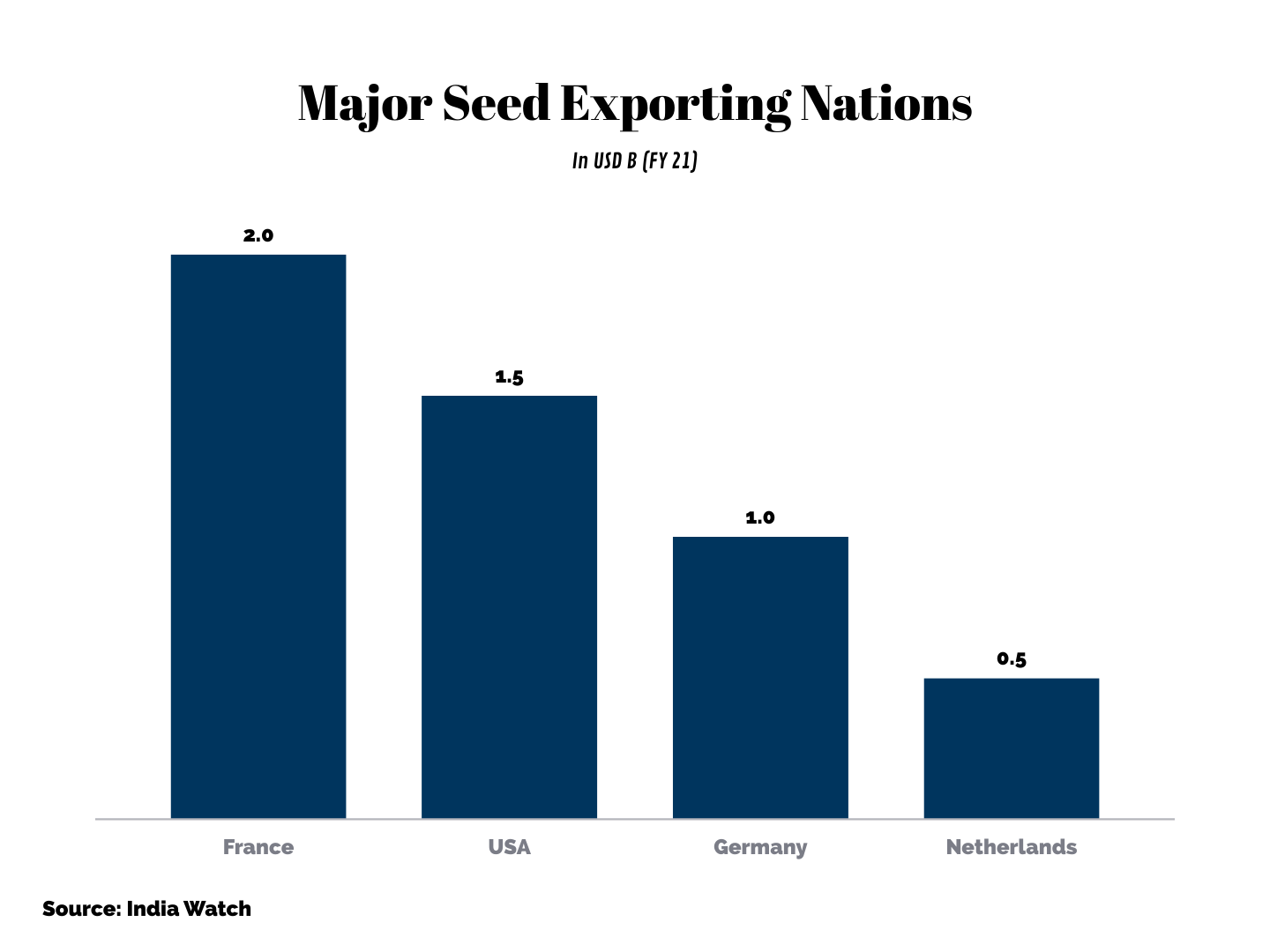

India's seed industry is growing at a CAGR of a little over 14%, which places it ahead of the global growth pegged at ~ 7.3%. However, India just has a toehold in the global seed trade. In a time, when cross-border trade is rising, the total global seed export market is worth around USD 12 Billion. Globally France and the USA are major exporters, contributing an export volume of USD 2 Billion and 1.5 Billion respectively. Other major economies playing a significant role in seed trade include Germany (USD 1 B) and the Netherlands (USD 500 million).

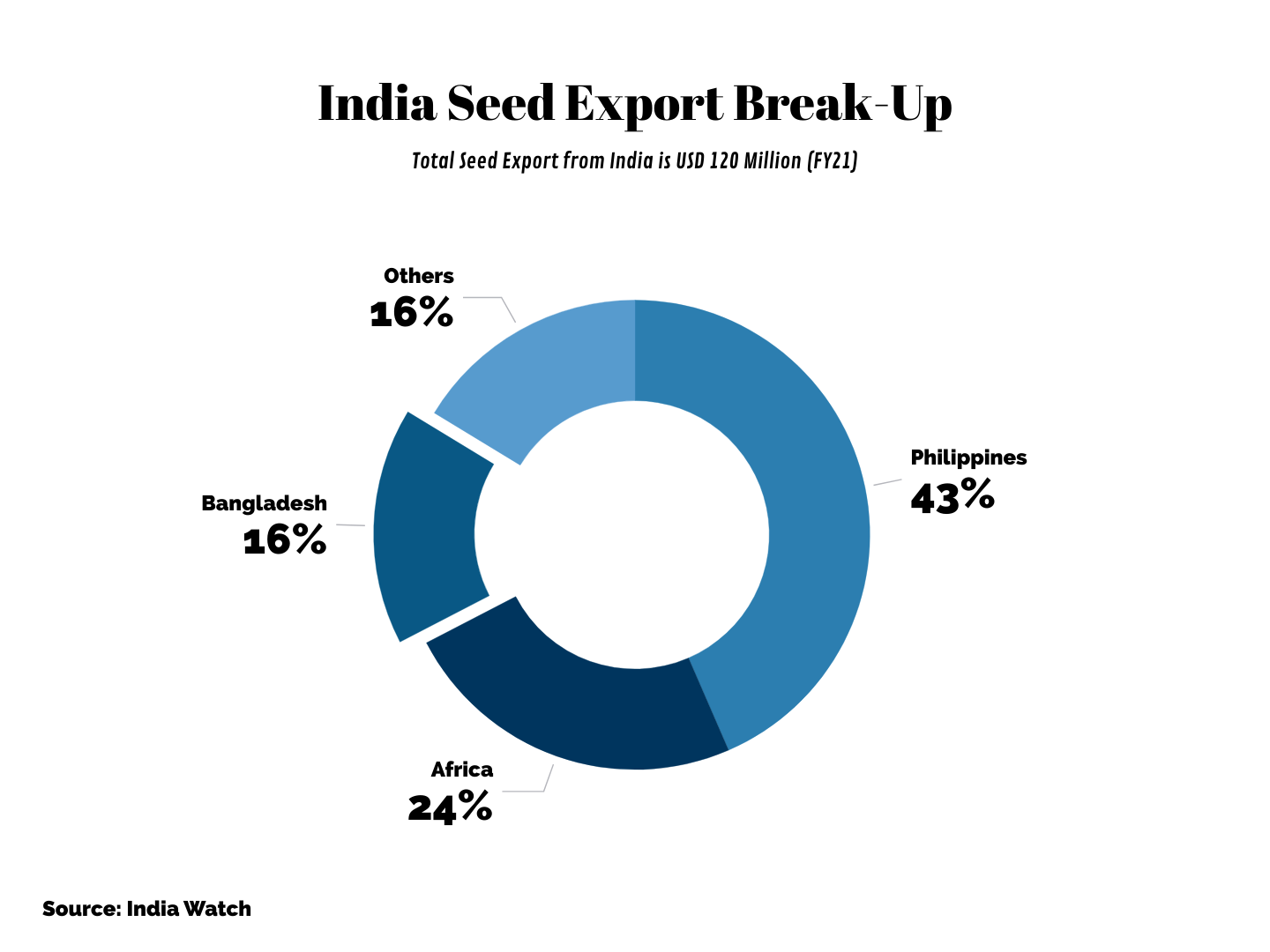

India's annual export is estimated at a little over USD 120 million. It primarily exports to the Philippines (43%), followed by Africa (24%) and Bangladesh (16%).However, India is home to 14 out of the 18 climate zones and can play a much vast role in the world seed trade. There are huge potential markets in Asia Pacific, Africa, and Latin America.

Factors Driving Growth in Global Seed Market

Globally demand for commercials seeds is increasing, which will unlock new opportunities for Indian seed breeders. Besides the developed market, there is tremendous scope in emerging markets of Asia & Africa. In these markets including India, the SRR rates have sharply risen in the past few years. In many categories, the SRR has passed 40% and there is further headspace for more growth, which is a healthy sign.

Mentioned below are some of the key factors, that will drive the global seed industry in a positive direction.

- The world population will reach 9.5 Billion by 2050, which will translate into increased demand for food. Food security and strengthening food supply lines are the prime concern of most of the developed as well as emerging economies. Increased demand for food in turn will result in heightened demand for seeds.

- Despite continuous actions taken to tackle food insecurity challenges, there is a visible gap in the market. Near around 850 million world population is not fed popularly. To curb down food shortages, the usage of high-yielding seeds will be required.

- In many nations, the food & farming sector including commercial seeds have been classified under essential business/ critical infrastructure. This has helped in minimizing the impact of COVID -Triggered disruptions.

- Popular categories such as maize, rice, vegetables, cotton, and soybeans will continue to dovetail the market in a positive direction. Vegetables will comprise ~ 40% of the total seed exports.

- Increased disposable income across the world is resulting in a change in food habits. The rise in demand for vegetables, edible oil, whole grains, and plant-based proteins will further help the seed industry.

- Arable lands are reducing all over the globe. Growth in food demand in conjunction with reduced land under agriculture will drive demand for hybrid & GM seeds with better yields.

Impact of COVID-19 on Seed Industry

The commercial seed industries have shown resilience in the face of the COVID crisis. However, the risks due to the pandemic can't be completely mitigated.

- COVID-19 has resulted in increased timelines of supply due to disruptions in logistics and delays in customer clearances. Speed to delivery is very essential in seed trading because supplies should reach within the sowing season. Otherwise, the production cycle gets disturbed.

- Due to the COVID crisis, freight charges have increased worldwide, resulting in incremental costs for seed producers and suppliers.

- Many seed breeders have reported a shortage of labor forces due to lockdown.

Can India Become the Seed Bowl of the World?

India has prolific seed production facilities, support infrastructure, and quality management systems to become a global leader in seed production. As mentioned above, it is also home to varied agro climates. Yet, its share in the global seed trade is just ~ 1%, as the industry has so far failed to scale up and match global standards.

However, through policy support and further incentives, seed export from India has the potential to reach USD 2.4 billion by 2030 (Roughly 10% of the estimated global seed trade of that time). To become a key player in international seed flow, India needs to focus more on exports. This will require investments in developing international markets, time-bound approvals, and easier documentation processes in place. The nation needs to develop dry port facilities with ample storage infrastructure for the speedy import and export of seeds.

India should also aim for a bigger slice in global custom seed production. In custom seed production, seeds are provided from the parent country to be mass-produced in host countries and then exported back. Presently countries like China and South Africa are dominant players in custom production. To be able to position itself as a viable alternative, India needs to exempt the registration process under Seed Act for the custom production category. It should also enforce stricter IP laws to safeguard the interest of parent seeds.

Get in touch with us!

To get more information

subscribe now