-

Your trusted market research partner

- info@theindiawatch.com

- 8076704267

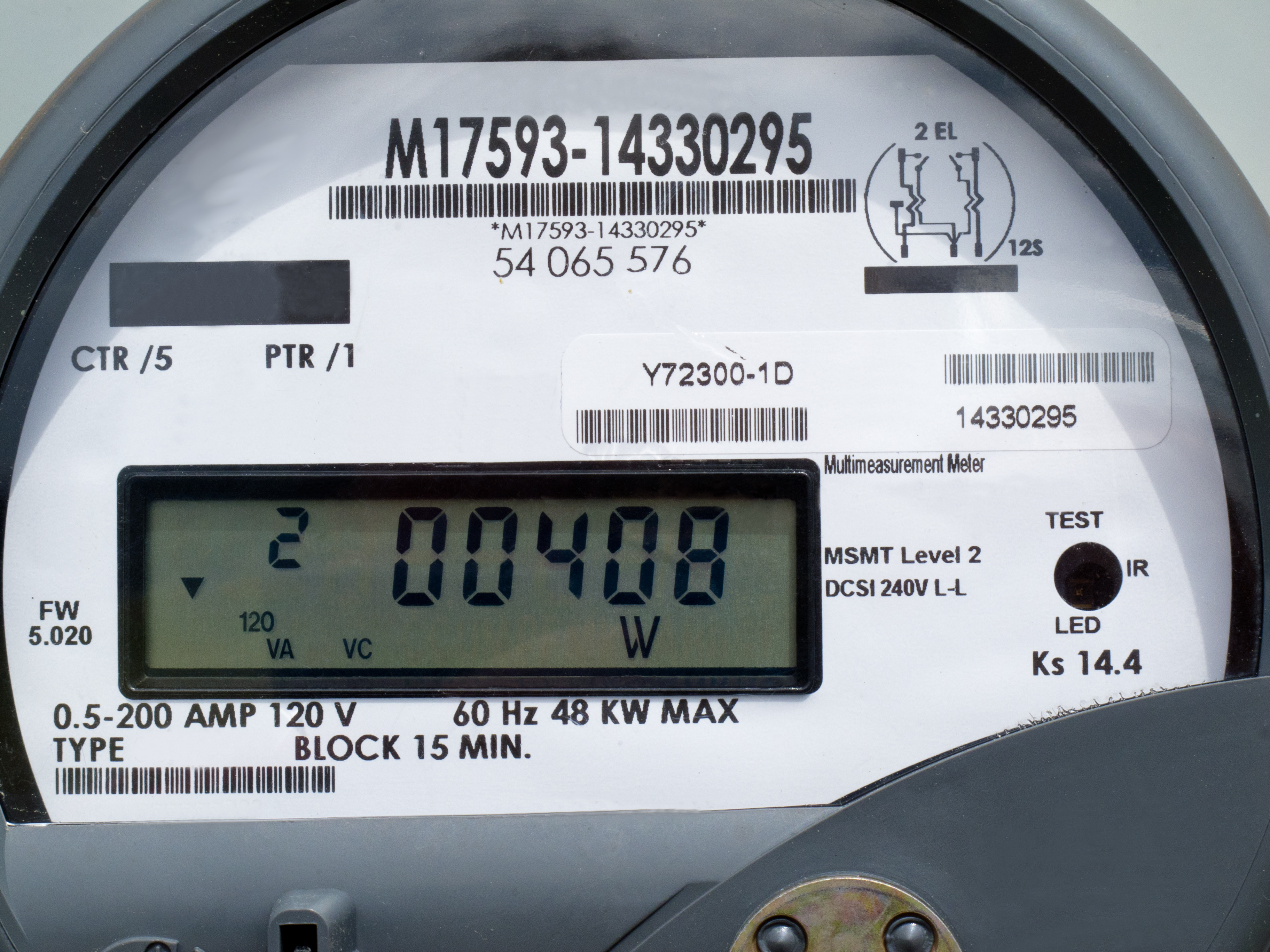

Presently Valued at USD 1.463 Billion, Smart Meter Industry has Potential to reach USD 18.6 Billion

The current volume of installed smart meters in India is around ~ 3.1 million. The penetration is just ~ 1.14% and is much lower compared to other major economies in the world such as the USA (~70%), France (~ 65%), & China (~ 45%).

However, under the Smart Meter National Program, India will gradually replace its 270 million traditional meters with smart meters. India is also working towards building an extensive Advanced Metering Infrastructure (AMI) to seamlessly integrate smart meters with the existing grid. This makes India one of the fastest-growing smart meter markets across the world.

Smart meters are associated with numerous benefits, both for the Distribution Companies (Discoms) as well as the end-users. It can significantly reduce Aggregate Technical & Commercial (AT&C) losses, automate the billing process, effectively manage outages and improve overall collections. Likewise, end-users can wield control over the power consumption through monitoring of historical data. An extensive smart meter network that can rationalize losses and build efficiency throughout the grid is also aligned with India's long-term objective to contain its Carbon footprint.

Presently the total size of the smart meter industry in India is USD 1.463 billion. The size of installed capacity is around USD 253 million, whereas USD 1.21 billion is under procurement. The future potential is estimated at USD 18.6 Billion. Earlier imports from China dominated the market. However, the governing agencies have now mandated domestic production capabilities for companies willing to supply smart meters. It is giving a major push to domestic manufacturing.

Industry Trends in Smart Meter Manufacturing

- Ideally, as the Discoms are the biggest beneficiaries of the smart meters, they should bear the cost of installation. However, most of the Discoms in India is marred by debt, thereby limiting their financial bandwidth. To expedite the process, a public sector enterprise namely Energy Efficiency Services Limited (EESL) has been formed which is paying the upfront costs of smart meter installation.

- EESL has inked deals with various states in India including UP, Bihar, AP, Telangana, Delhi-NCR, Rajasthan, Haryana. EESL will bear all the design, installation, operation & maintenance costs of the smart meters in Indian provinces. In return, it will charge a monthly rate from the state Discoms. Once the cost of the meter will be recovered, the ownership will be transferred to the Discoms.

- In 2019, EESL has awarded EDF, a French smart meter company to roll out 5 million meters (Out of this, 2.34 million smart meters will be installed in the province of Bihar). EDF has already deployed 100,000 meters.

- EESL has also partnered with the National Infrastructure Investment Fund (NIIF), a GOI-backed sovereign wealth fund to form Intellismart, to further oversee the procurement, installation, and maintenance of smart meters all over India. To speed up the deployment of smart meters across the country, GOI has also announced a financial package of USD 3.1 billion. The stimulus will be transferred in the form of an individual subsidy of INR 900 (USD 12.1) for each meter installed. In case the state agency can complete the installation process by 2023, an additional subsidy of INR 450 (USD 6) will be offered.

- Traditionally Chinese manufactured smart meters dominated the Indian market. However, as a part of the Make in India Program and Import substitution policies, indigenous manufacturing capabilities are developed. The EESL tender process mandates the supplier should have manufacturing facilities based out of India. Besides multinational companies such as Schneider Electric and EDF with production facilities in India, indigenous manufacturers such as HPL Power & Electric, Genus Power, Zen Meters, Avon Meters, Linkwell Telesystems, etc. have also ramped up their production capabilities, thereby enriching the overall industry.

The Way Ahead

Smart meters have multiple usages and the power ministry, governing agencies, Discom companies together with EESL and Intellismart will remain committed to replacing the existing metering systems with smart meters. An extensive smart meters network will help in lowering the AT&C losses, which are high in India. As per the report by Central Electricity Authority (CEA), in FY 19, the total AT&C losses amounted to 20.66%, marginally reducing from 21.04% in FY 18. It has been estimated that following the widespread deployment of smart meters, the AT&C losses can be reduced to less than 10% by 2027.

The lockdown during the pandemic has also reinforced the significance of the smart metering system. During the lockdown, it has been nearly impossible to physically collect tariffs, thereby further undermining the revenue streams of Discom companies. Remote monitoring and collection through smart meters can be a possible alternative in near future to ensure a smooth and seamless collection of tariffs.

Meanwhile, the regulatory bodies will also need to formulate stronger privacy rules, as smart devices have access to a lot of personal information of users including their device usages and entertainment preferences. Policies should be put in place to clamp down on any malpractice of selling personal information.

How India Watch can Help

Interest in smart meter manufacturing is bound to rise in the times to come as India's aggregate potential is close to USD 18.6 billion. Domestic manufactures will ramp up their production while international players will set up new production units in the country to fill the gap. This will however also require cohesive access to, market/ industry data.

As an India Centric Market research and information advisory €œIndia Watch€ can provide the needed research and data to help companies make winning decisions. Our host of services include but are not limited to the following:

- Tailor-made research & data on market/ industry

- Detailed insights on the policy framework, competitive landscape, pricing strategy, market segments, etc.

- Opportunity assessment studies capturing the latest tenders by governments, state-run & private Discom companies, EESL, etc.

- Besides manufacturers, our research services can be availed by power generation companies, Discoms, Infrastructure Investment Funds, etc to gain granular insights on the market.

- Consultants can avail of our services to prepare project feasibility reports