-

Your trusted market research partner

- info@theindiawatch.com

- 8076704267

Payment Gateway Companies in India Clocked a USD 768 M Revenue in FY 21

As one of the fastest-growing digital economies in the world, payment gateway adoption in India is on a steep uprise. The pandemic, which has forced most of the businesses in India to quickly embrace digitization, has also pushed the industry in an exponential growth trajectory.

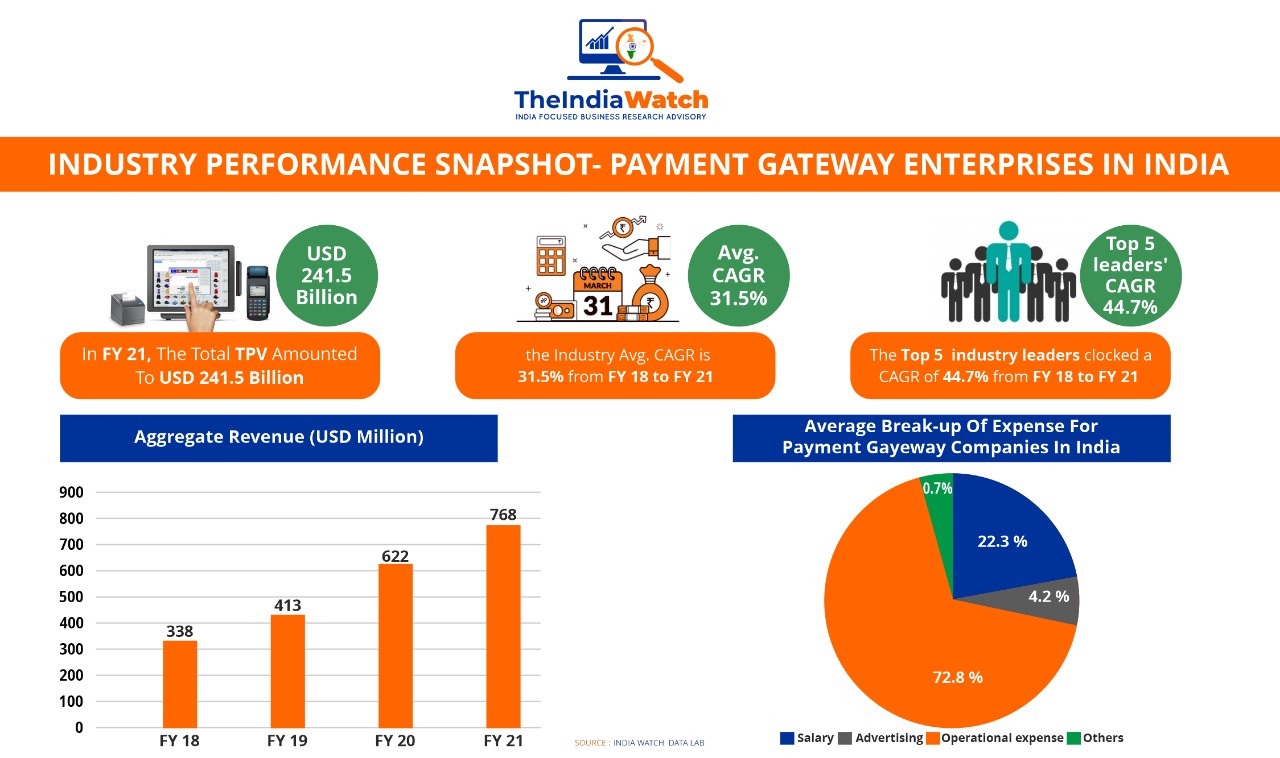

In FY 21, the Indian payment gateway industry clocked an aggregate revenue of USD 768 million, registering an annual jump of 30.7%, despite commercial activities getting affected during the lockdown period. In the last 3 years, the industry has moved up at a CAGR of 31.5%. The top 5 players in the industry (Infibeam, PayU, PayPal, Bill Desk, Razorpay) clocked an average CAGR of 44.7% in the same period.

In FY 21, the Total Procession Value (TPV) amounted to USD 241.5 billion, further underlining the significant position played by payment gateways in India's rapidly growing & evolving digital payment ecosystem.

In the times to come, the payment gateway industry in India will continue to move upwards in a positive direction, backed by the growing popularity of e-commerce platforms and a steady rise in card penetration. Global giants such as Nasper technologies and PayPal are increasing their stake in the Indian payment gateway industry, lured by the long-term growth potential of the industry. The payment gateway industry in India will also draw dividends from a younger tech-focused consumer base.

Industry Trends: M&As and Investment Inflows

- Nasper Technology-backed PayU is set to acquire Bill Desk following an investment of USD 4.7 billion. The combined entity has a TPV run rate of USD 147 billion. Bill Desk is the biggest player in bill payment in India and the acquisition will help PayU to build a robust financial payment ecosystem in the country. Earlier in 2016, PayU has acquired citrus following an investment of USD 130 million.

- The previous year, PayU acquired Paysense, a consumer lending platform for USD 185 million. To leverage the rising digital consumerism wave in India, Payment gateways are now also venturing into the alternate consumer lending space. Parallel platforms are being developed to find the credit scores based on consumer information such as bank statements records, mobile data, social media consumption data, etc. Razorpay through Razorpay capital has entered the lending space in 2019, while Infibeam is also making inroads into the category soon.

- The multifaceted nature of the payment gateways companies will continue to evolve in near future with an increased focus towards becoming a full-stack fintech enterprise. Capabilities across ancillary businesses such as consumer lending and enterprise software development will be developed.

- In April 2021, Razorpay has received fresh funding of USD 160 million from GIC and Sequoia Capital, thereby significantly increasing its overall valuation. Mastercard has invested in Bangalore-based Instamojo to scale up the MSME and freelance verticals.

How India Watch Can Help

The India Watch is an India-focused market intelligence and business research advisory that keeps a close eye on India's evolving fintech, digital payment, and financial ecosystem. Our research and data can help enterprises, investors, start-ups, and sovereign agencies to make winning decisions in the Indian market.

- We can offer research & data on industry size, market trends, future growth trends.

- Data on the existing market players alongside their growth numbers, financial data, and future strategy

- We can offer insights on consumer behavior on digital payment

- Current deal inflows and future pipeline

- Policy framework on digital payment in India

- Our research comprises valuable primary data backed by exhaustive secondary research

- We can tailor-make the research as per clients' requirements- from an excel sheet with the needed data points to comprehensive industry reports.