-

Your trusted market research partner

- info@theindiawatch.com

- 8076704267

India Data Centre Market Outlook 2021-24: Investment of USD 6.64 B Expected

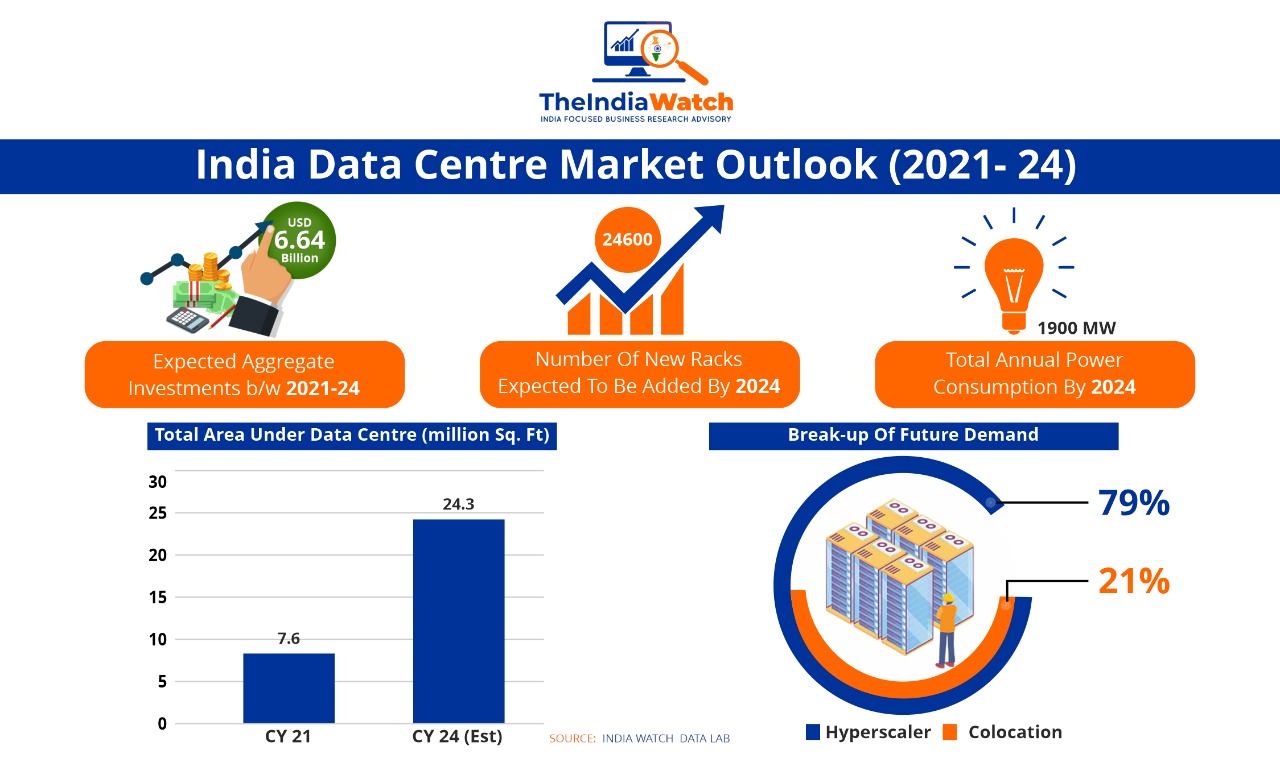

In a new age economy, where a parallel is drawn between Data and Oil, data centres are increasingly gaining prominence. In India as well, the demand for data centres are set to rise in the foreseeable future. The data centre market in India is set for momentous growth in the next 3 years, with an expected investment of USD 6.64 Billion between 2021-24.

The data centres growth in India will be driven by both international and domestic demand. India has the potential to become a data centre hub in the Asia Pacific (APAC) region. India's stronghold in the global IT/ ITeS, BPO, Offshore industries, makes it a conducive location for the regional and global data centres to move in. Besides, India has an inherent cost advantage, which will further foster growth. The total cost of making data centres in India compared to China and Singapore is 10% and 25% less respectively. The cost of operation is lower by around 10-20%.

Global Data Centre giants like NTT Japan and ST Tele Media are increasingly expanding their foothold in the data centre market. NTT has an extensive pipeline in India worth USD 2 billion. Following its first data centre in Mumbai in 2016, Amazon Web Services (AWS) has opened its 2nd data centre in Hyderabad. Cloud service providers like AWS, Google, etc. are increasing their stakes in the Indian market.

Major Indian conglomerates like Adani and Reliance have also ventured into the lucrative data centre space. Developers such as Hiranandani are also aggressively investing in developing data centres in the country. In a time, when demand for traditional commercial real estates such as retail and office spaces will be muted, upcoming asset classes such as data centres will garner increased interest from developers and investors.

Presently, the total annual absorption of power by the data centre industry is pegged at 590 MW. However, it is poised to grow to 1900 MW by 2024. The total area under the data centre is set to reach 24.3 million sq. ft. during the same period. Hyperscaler will comprise 79% of the demand, while the remaining will consist of colocation data centres.

Growth Drivers of Data Centres in India

- Quicker cloud adoption: The Covid situation has forced quicker and faster cloud adoption. To maintain business continuity and show greater resilience in the face of the crisis, enterprises started adopting cloud services. Larger enterprises, as well as SMEs, are increasingly hosting their email application, data warehousing, analytics operations, etc on the cloud. Public cloud companies such as Amazon and Google are also expanding their foothold in India to meet growing demand.

- Growth in Digitization: India is one of the largest data markets in the world. As of January 2021, as per the datareportal report, total internet users in India were 624 million, climbing by 8.2% on an annual basis. India's mobile phone usage stood at 1.1 billion. The smartphone subscription stands at 680 million, with a usage of 14.6 GB of data per month on each smartphone device. The total number of social media users in India during the same period was estimated at 448 million, adding 78 million users between Jan 2020 to Jan 2021.

- Digitization of services: India is touted as one of the fastest-growing digital economies in the world. Numerous services such as healthcare, education, banking, etc. are increasingly getting digitalized. India's online healthcare consulting will reach USD 290.1 million by the end of FY 22, growing by over 10X in the last 4 years. Currently, the fintech industry in India was valued at USD 2.5 billion, comprising 5% of the global fintech industry. The lockdown last year resulted in most of the education companies embracing the online medium with the online education market presently crossing over USD 2 billion. Growing thrust to the digitization of services will feed into increased demand for effective data storage and management facilities.

- Growing Popularity of Content, Gaming, & OTT: India's digital consumption patterns are shifting, which has been further spurred during the pandemic. Both indigenous, as well as international OTT platforms, are soaring high in popularity with aggregate userbases set to reach 500 million by the end of the current fiscal. Across the mobile platforms alone, there are over 350 million video viewers. India's mobile gaming market, which is presently estimated at USD 1.2 billion, is expected to jump by another 150% in the next 18 months, as per media reports.

- 5G Rollout & IoT devices: The rollout of 5G in India is expected to bring a tectonic shift in data consumption, both at an individual as well as enterprise level. As 5 G will increase the internet speed by manyfold compared to 4G-LTE networks, data usages will go over the roof. 5G will also drive growth in IoT, remote devices, and smart technologies.

Industry Trends in Indian Data Centre Market

- India's multisector infrastructure conglomerate Adani has recently ventured into the development and management of the Data Centre. In February 2021, it has formed a 50:50 partnership with multinational data centre company Edge ConneX. Adani's presence in a host of infrastructure verticals such as power & renewable energy, transmission, and real estate will complement Edge ConneX expertise in data centre development and management. The JV will build both hyperscale as well as hyperlocal edge data centres in the country.

- Japan NTT will continue to be one of the leaders in India's growing data centre industry with an investment pipeline of USD 2 billion. Besides augmenting existing capabilities, NTT will set up new data centres in Navi Mumbai, Chennai, Noida, etc. NTT is also investing in developing renewable energy capabilities to meet the power requirement of its data centres through sustainable means.

- Major Indian developer Hiranandani has ventured into the hyperscale data centre and data centre park with its inaugural project in the Mumbai region the previous year. There are two major projects currently under construction in Chennai and Noida- slated to be operational in Dec 2021 and Mid-2022 respectively. Namely Yotta Infrastructure, Hiranandani plans to build more data centres in various other parts of the country.

- Besides large-sized hyperscale data centres, India will also witness an increased thrust towards hyper-localized Edge Data Centres stemmed by growing demand for OTT, video content, and real-time data. In the next 3 years, around 15,000 new edge data centres will open in India, out of which 30% will be micro centres. A sizable portion of such data centres will also be concentrated in tier 2, 3, & 4 cities to meet the growing digital demand in rural and semi-urban India.

How India Watch can Help

As multi-sector research and data provider, including infrastructure, real estate, and ICT industry, The India Watch has ample knowledge of India's evolving data centre market.

- We can offer research and data on industry trends, demand drivers, market growth, competitive landscape, etc.

- We can offer detailed insights on existing deals and future pipelines

- Region-wise break up of the industry

- Break-up of the industry based on product type.

- Developers, consultants, cloud companies, etc can also avail of our tailor-made research services on data centres.

- Industry bodies and associations can use our service to compile Industry report pieces.