-

Your trusted market research partner

- info@theindiawatch.com

- 8076704267

Analysis of India's Evolving UPI Transaction Market

India's mobile payment has risen sharply in recent years. The upcycle, which was initiated during the demonetization drive has received a further big thrust when lockdowns were imposed last year. The covid crisis, which resulted in a virtual shutdown also forced millions of Indian households to upgrade and use the mobile to make the payment for their daily essentials, medicines, grocery, and other important items.

Besides big events such as demonetization and pandemic, which resulted in a swift shift in consumer behavior, India's mobile payment growth is also party to a much favorable socio-economic factor. Out of a population of 1.3 billion Indians, ~ 65% of Indians are aged less than 35. More than half of the Indians are aged below 25. A young technology-friendly consumer base makes India a fertile ground for cashless culture. India also has one of the cheapest 4G internet prices in the world, which has bolstered growth in mobile commerce and payment.

UPI Market in India

UPI is the preferred mode of payment in India, compared to wallets. UPI is also known as Unified Payment Interface has been backed by the GOI and is built with the help of a network of retail banks. It is a regulated entity by the Reserve Bank of India (RBI) and offers an instant mobile cash transfer facility through IMPS network.

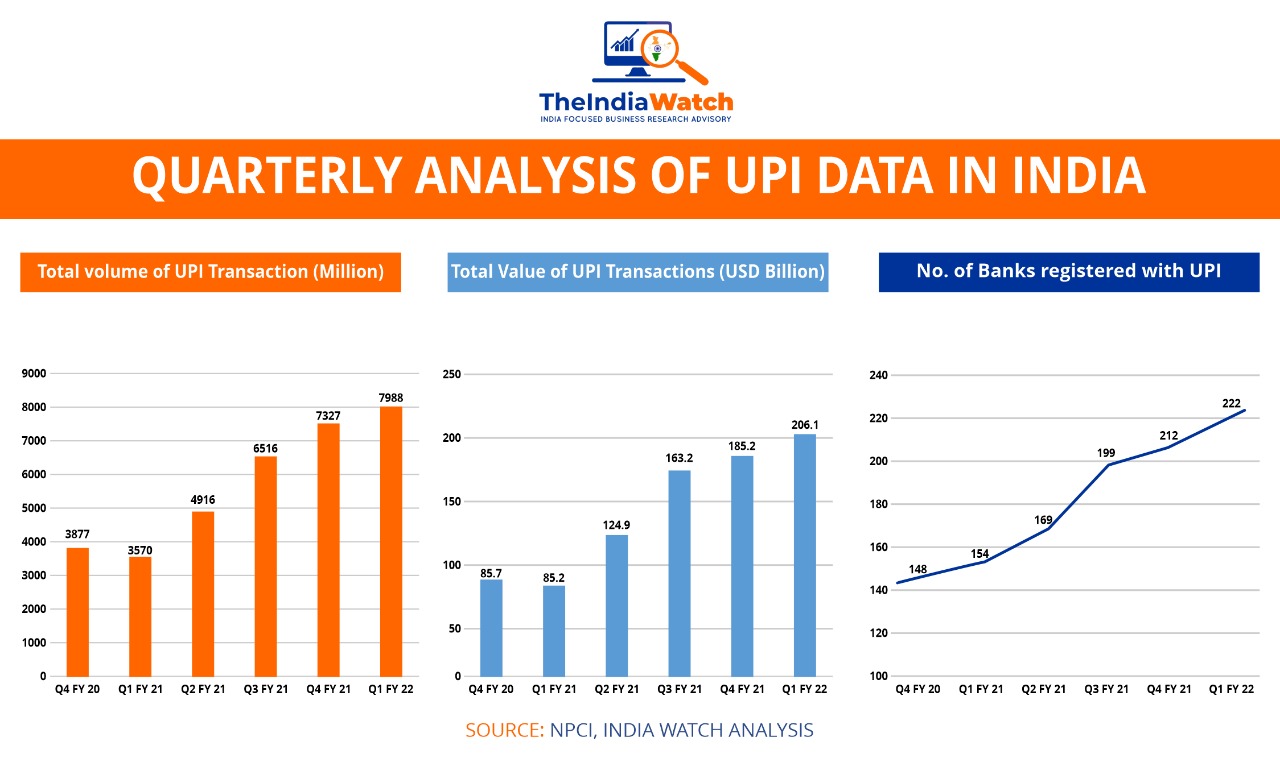

As of June 2021, there are 222 Indian banks, which are part of the UPI ecosystem. The quarterly transactions through UPI amounted to USD 206.1 billion, climbing by 140.5% in the last 15 months. When the first lockdown was imposed, the value of transactions marginally dipped due to virtually no business activities. However, in the July-Sep quarter of 2020, the value of transactions reached USD 124.9 billion jumping by 46.6%. During the same period, the aggregate volume of transactions reached 4916 million, moving up by 37.7%.

Phonepe (backed by Flipkart) is the market leader in India's growing UPI-based payment ecosystem. This is followed by Google Pay. Other major players include Amazon Pay, Paytm, etc. Besides a steep rise in digital consumerism, these apps also adopted aggressive cashback and reward strategies that have further helped in the rise in popularity. As an evolutionary market, UPI apps are also adding new services and are not just limited to money transfer, bill payment, and making retail purchase. UPI apps are enabling users to buy stocks and mutual funds, book tickets, etc.

Key Policies in India UPI Ecosystem

The government is committed to encouraging the adoption of UPI through policy intervention as it is aligned with the long-term objective of developing Digital India. UPI alongside other digital payment systems also helps in seamless tax collection.

- In November 2020, NPCI has notified a cap of 30% on 3rd party UPI apps. The policy is still in its initial stage with incumbent players given 2 years for compliance.

- Earlier a 1% Merchant Discount Rate (MDR) was levied on the payments that businesses received from their customers, which shared equally b/w issuing bank, receiving bank, and the fintech platform. MDR was waived off in 2019. However, banks and fintech entities are urging NPCI to deploy it again to make UPI systems profitable in the long run.

- Earlier in 2020, banks have also urged RBI and the GOI to share the cost of developing UPI infrastructure. Annually USD 700 million is spent towards circulating cash and since UPI system reduces overall cash circulation in the system, GOI may contemplate sharing the cost.

Becoming Full Stack Financial Service Provider

Popular UPI apps such as Phonepe, Google Pay, Paytm, and Amazon Pay, etc. have millions of users registered on their platform. Leveraging the database, most of the UPI providers are now aiming to become full-stack financial service companies. Amazon Pay is mulling to become a marketplace for easy loans and insurance services for grocery shops, small merchants, etc.

The previous year, Phonepe acquired a corporate agent license, which allowed it to sell 3 insurance policies across major categories- health, life, and general. This year it has obtained an insurance broking license, which will enable it to sell all kinds of insurance policies over its platform. The top management of the company has also hinted that they are looking to get a mutual fund business license.

Recently, Phonepe has also received Account Aggregator (AA) license from RBI. The AA framework created in 2016, allows easy and seamless sharing of customer information with banks digitally. Based on the information, these financial entities can decide whether to offer loans or not. The AA in return will charge from the Bank and/ or customer a fee amount.

Google Pay has partnered with Flexi Loans, an MSME-centric credit platform to facilitate easy & flexible loans for small merchants in India. Soft Bank-backed Paytm has also built a layer of financial services across its core business, which includes native lending platform, native stock brokering, native insurance brokering, credit platform, etc.

How India Watch Can Help

The India Watch is an India-centric, business research & information advisory. We have multi-sector knowledge of the Indian economy and business including the evolving fintech, digital payment systems, banking technology systems. We can offer you tailor-made research attuned to your business objectives and budget.

- In-depth data on industry size, consumer behavior, market growth, market segments, future forecast, etc.

- Data and research on competitive landscape, industry players, their financial numbers, etc

- Business plan and feasibility studies for new ventures and start-ups

- Custom research for investors and private equity players

- Editorial, presentation, and strategic content services