-

Your trusted market research partner

- info@theindiawatch.com

- 8076704267

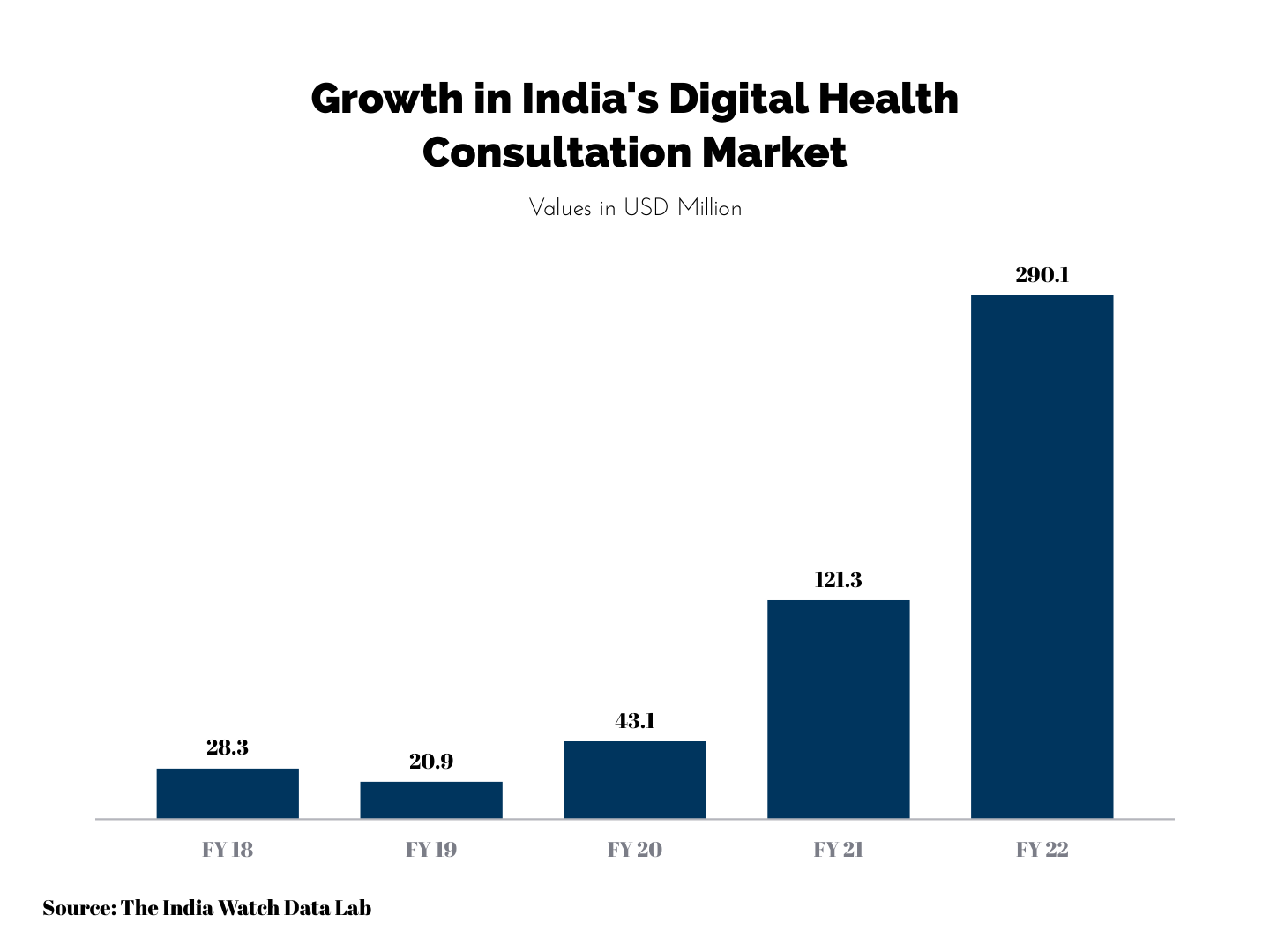

By FY 22 Indian E-Healthcare Consulting Expected to Reach USD 290.1 M

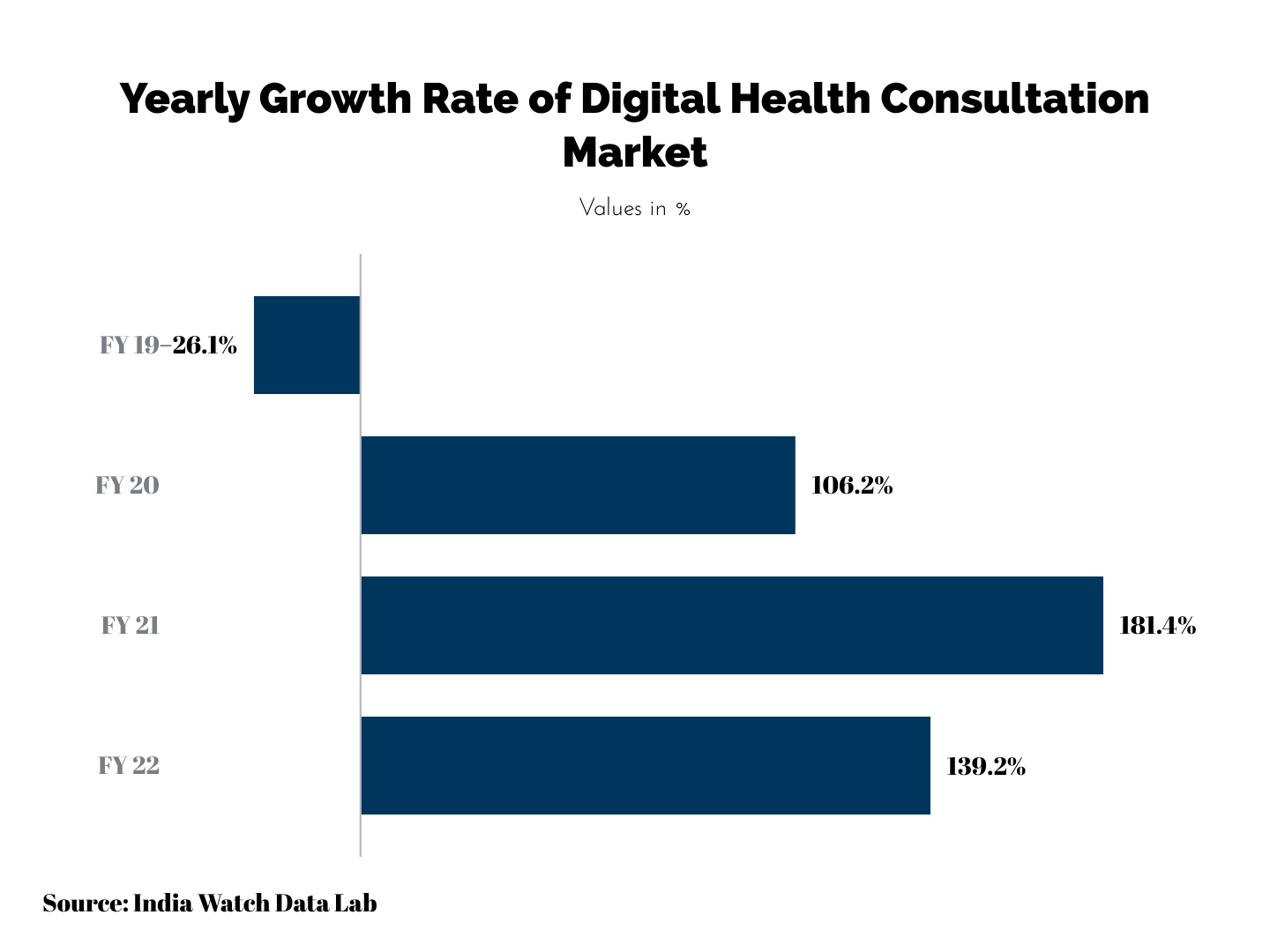

The Indian digital health consultation market is still in its infancy. The overall market is expected to reach USD 290.1 million by FY 22, growing at a CAGR of 78.9% over the past 4 years. However, the market has tremendous potential to grow. During the lockdown period, millions of Indian households were forced to download popular e-consultation apps like Practo, Lybrate, Doc Prime, etc. resulting in a steep jump in the business.

Around ~ 50% of Practo patients, India's largest e-consultation app are newcomers, underlining the growing significance of healthcare apps. Lybrate, another upcoming platform has registered around ~ 200,000 doctors in 2020.

India's favorable demographic dividend, rising demand for safe and contactless services, and increased smartphone & 4 G penetration will continue to dovetail the e-consultation industry in a positive direction. The growth in the industry will also stem from growing government support for digital health. The Indian government has unveiled a digital healthcare blueprint in 2019, which aims at offering access to quality healthcare services to every Indian citizen.

Going forward, digital health can play a major role in bridging gaps in healthcare infrastructure. It can bring in operational efficiency, complement the regular healthcare systems, and improve the currently strained rural medical infrastructure. 60% of Indian doctors are located in urban India, which constitutes 32% of the Indian population. This strains the rural healthcare facilities. The rising popularity of healthcare apps can play an instrumental role in bridging the gap and offer quality consultation in Indian villages.

Key Industry Insights in the E-Healthcare Consultation

- The Indian digital healthcare consultation industry is in its evolutionary phase. Apps like Practo, Lybrate, Doc Prime, are investing heavily in developing an extensive ecosystem to offer seamless integration for both doctors and patients, Existing medical chains such as Apollo are also entering online consultation.

- Other platforms such as Medlife, Pharmeasy, 1 MG, etc. which are primarily e-Pharma platforms are now venturing into the lucrative e-consultation category. Likewise, e-consultation platforms such as Practo, MyUpchar, etc. are now partnering with a network of pharmacies to offer door-to-door delivery of medicines.

- The pandemic period saw a strong thrust to the e-consultation industry in India, as the digital medium becomes a trusted source of offering medical advice. On an annual basis, e-healthcare consultation jumped by 181.4% in FY 21. There is also a tremendous untapped market in small towns and rural India. To further expand its footprint in the hinterlands, these apps are also coming up with content in vernacular languages.

- Consulting platforms are investing in advanced technologies such as AI & machine learning. Use of AI & machine learning can play a significant role in the areas of problem diagnosis, information synthesis, prescription capture, patient history analysis, etc.

Key Investments, M&A, Tie-Ups

- Practo, which is a market leader in India, has acquired a host of start-ups which include data analytics platforms, web & mobile app development companies, hospital management software, doctor's appointment booking platform, etc.

- Following a seed funding of USD 1.2 million in 2014, Lybrate has received funding from Tiger Global, Nexus Ventures, and Tata Sons.

- DocPrime, which is backed by PolicyBazaar (India's leading online insurance provider) has received USD 50 million from the parent company in 2018. Besides teleconsultation and diagnostic booking services, the venture is also active in health insurance services.

The Way Forward

The teleconsultation market in India is in its initial phase. However, the pandemic has induced a major change in consumption behavior. Millions of households are now comfortable in accessing quality healthcare through the virtual medium. Besides serious ailments which need physical visits, a large portion of common as well as specialty ailments can be treated online.

Healthtech start-ups will also expand their foothold by seamlessly integrating the healthcare ecosystem including doctors, patients, clinics & hospitals, diagnostics, pharmacies, etc. In addition to catering to regular B2C clienteles, these start-ups will also tap into corporate clients, where the demand is bullish. Post pandemic, corporates in India are becoming more serious about the health and wellness of their workforce.

Leading start-up Practo itself has partnered with ~ 100 corporates including Tata Realty, Hexaware, L&T Finance, and Marico, etc. The corporate plans offer integrated services such as instant online consultation, health check-ups, COVID screenings, sessions on mental health, doorstep delivery of medicine, etc.