-

Your trusted market research partner

- info@theindiawatch.com

- 8076704267

International Participation Bound to Rise in Indian Metro Network

Indian economy grew at a commendable pace in the past three decades. As a natural corollary to economic progress, Indian cities and urban corridors expanded at an unprecedented pace. The flip side of the growth story has been the straining of resources and civic facilities in the cities. As the urban population swelled, traffic woes and challenges of congestion grew.

To systematically manage the bottleneck, the Indian government is aggressively building mass commute systems such as metro networks. Comprehensive metro networks, which are further backed by suburban networks and rapid transit lines are part of GOI's objective to enhance the overall living standards of residents alongside improving regional economic climate.

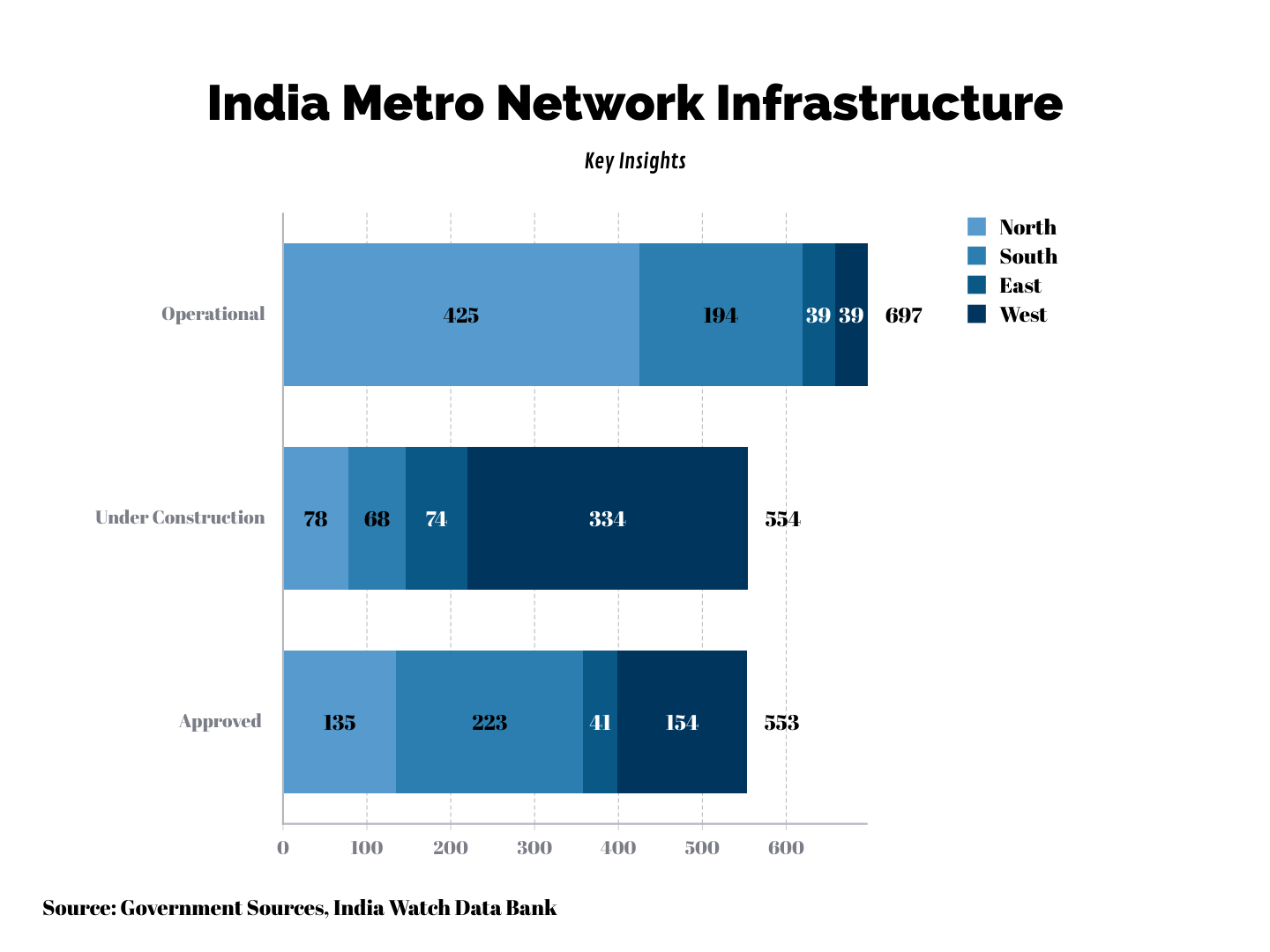

Though the first metro network in India was operationalized in 1982 in Kolkata, 2002 marked an eventful year in the history of the Indian metro when work began in Delhi. By 2014, around 240 Kms of the metro line was working in the country. Currently, 697 Kms of the metro line is operational and another 554 Kms is under construction.

There are around ~ 40 projects in the pipeline including 551 Kms of approved network and another 926 Kms, which have been announced. It will require an aggregate investment of around USD 36.2 billion.

The Delhi Metro is the largest operating metro network in the country, spread across 348 Kms. The daily ridership of the Delhi metro reached ~ 6 million before the lockdown. 170 Kms of the metro network is under construction in Mumbai, making it the largest undergoing project.

Not just in metros, but in a host of Tier 2 cities such as Kochin, Kanpur, Agra, Patna, Nashik, Jaipur, Lucknow etc. metro construction is going full swing. For instance, in 3 cities (Agra, Kanpur, Meerut) of UP, the largest province of India, an aggregate investment of USD 5.6 billion has been made to develop expansive metro lines. This further underlines GOI's commitment to developing prolific mass transit lines to offer faster, safer, and cleaner commute in Indian cities.

International Investors Gaining Confidence

Around ~ 20% of metro projects are executed under the PPP model in India, while the remaining are funded with the help of the Special Purpose Vehicle (SPV). In SPV close to half of the funds are raised from international and domestic lenders in the form of debt and equity. The remaining funding is done via state and central government.

As more metro projects in India are successfully taking off, international investors including SWFs, banks, development agencies, etc. are gaining confidence in the long-term profitability of such projects.

List of Recent International Investment in Indian Metros

- Japan International Cooperation Agency (JICA) is one of the biggest fund providers in Indian metro infrastructure. Through soft loans, it has supported all the 3 phases of Delhi Metro, India's biggest metro network.

- JICA has committed to invest USD 1.8 billion in phase 4 of the Delhi metro. It has also invested in the expansion of the Bangalore and Mumbai metro lines.

- The European Investment Bank (EIB) will invest ~ USD 770 Million in the Kanpur metro rail project. It is EIB's biggest investment out of Europe. EIB has also poured over USD 530 million in Lucknow metro project.

- Asia Infrastructure Investment Bank (AIIB) has invested close to USD 1 billion in Indian metro projects. Asian Development Bank (ADB) in 2019 offered a loan of USD 926 million for the Mumbai metro line.

- KFW, a German government-run bank has lent USD 510 million to support Nagpur metro, located in the province of Maharashtra. Recently French Development Agency has offered funding support of USD 295 million for the Surat metro project, situated in the province of Gujarat.

Unlock New Opportunities for International Companies

India's expansive metro network will unlock new opportunities for international contractors, manufacturers, and engineering companies. Already more than 100 projects have been awarded to international companies since 2003. These companies include German, French, Canadian, Korean, Japanese, and Chinese enterprises.

Going forward in the USD 36.2 billion worth pipeline of new metro projects, numerous new opportunities will unravel for international and domestic players.

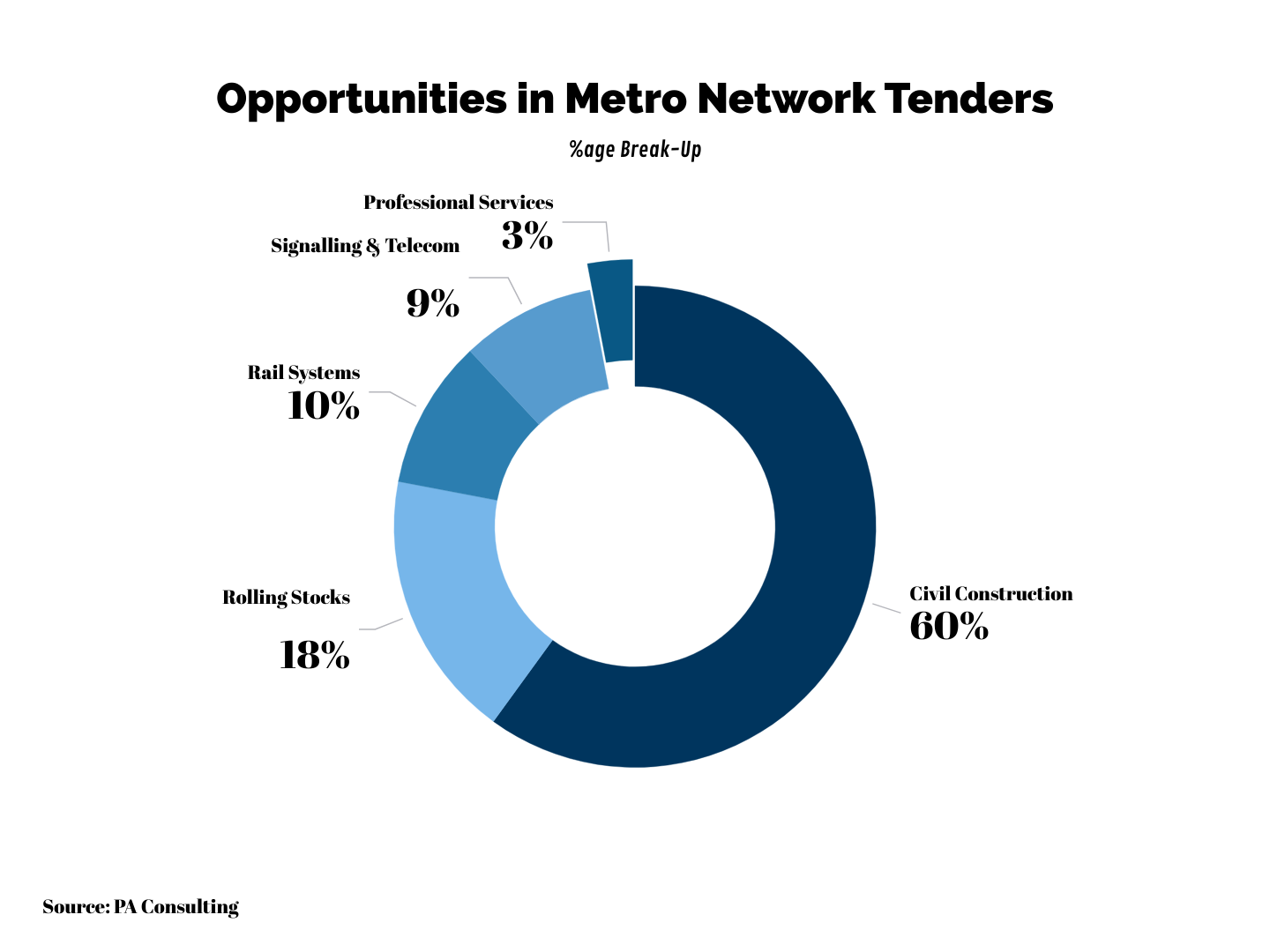

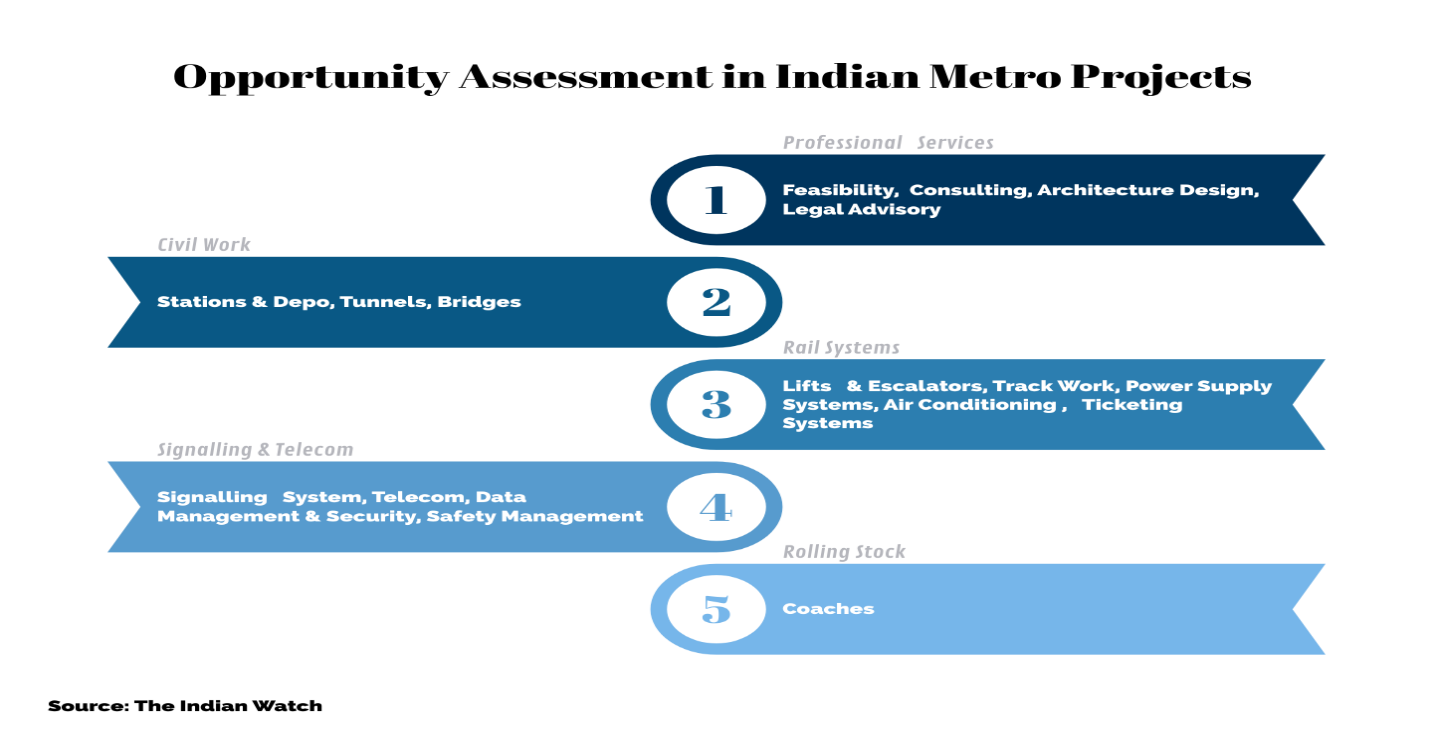

Around 60% of tenders (value-wise) will be related to civil construction followed by Rolling Stocks manufacturing, which will comprise a little less than a fifth of the total value. International players like Bombardier and Alstom are already active in the segment. They have also set up manufacturing capabilities in India. The consulting and advisory space comprises just ~ 3% of the total value but is marked by the increased presence of international entities.

India also has big indigenous contractors & engineering companies such as L&T, Punj Loid, Reliance, Gammon India, etc; with proven capabilities of timely delivery of large-scale metro projects. This will intensify competition in the times to come. However, there will be a lot of opportunities for JVs and need-based partnerships, which can be beneficial for all the stakeholders involved.

Though International companies can enter through the open and direct bidding process of the Indian metro, given the complex and multifaceted nature of metro-network construction, it is advisable to be part of a consortium or ink JVs with domestic manufactures. Besides, there are also immense opportunities in the subcontracting space, which companies should target.