-

Your trusted market research partner

- info@theindiawatch.com

- 8076704267

Despite High Capital Investment Hydroelectricity is Integral to India's Clean Energy Ambitions

As one of the fastest-growing emerging markets in the world, India's energy appetite is vast. India's growing, industrial sector, businesses, and agriculture, alongside individual households require power. Seamless supply power is the cornerstone to India's ambition of becoming a USD 5 trillion economy in the future.

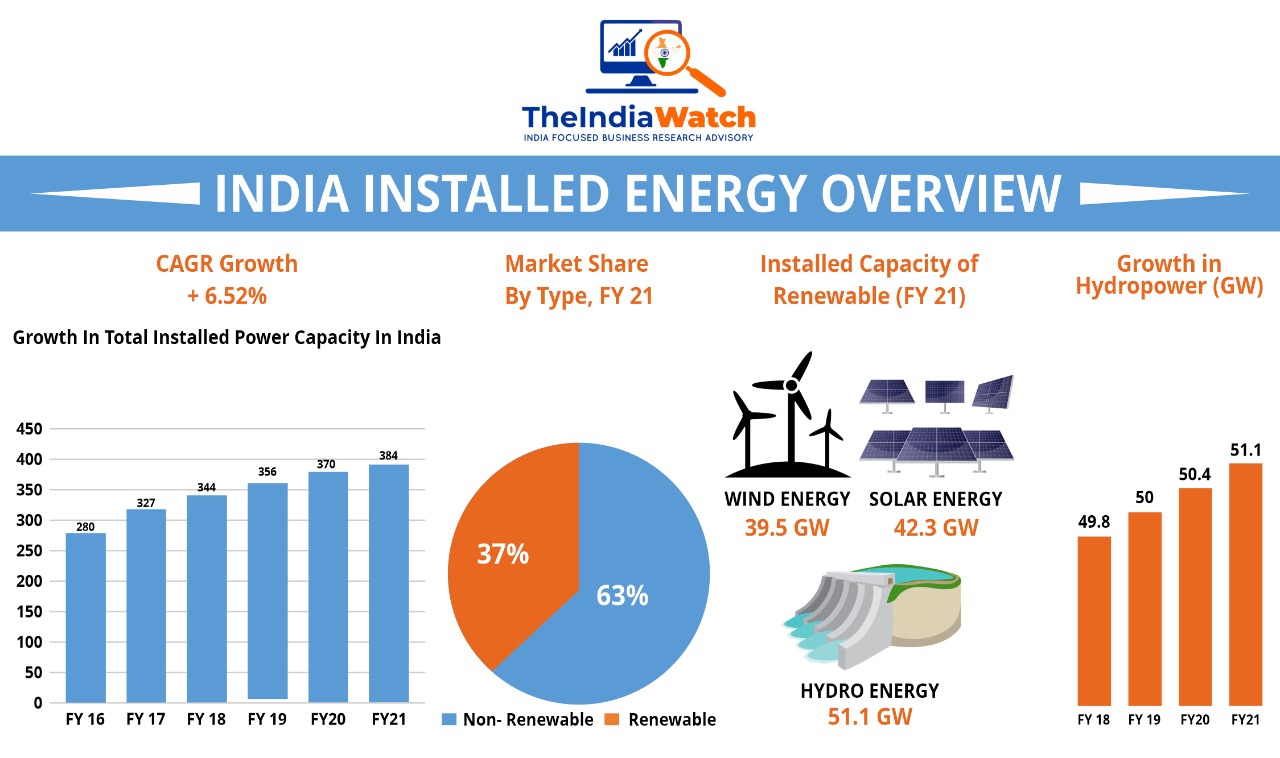

The country with an aggregate installed power capacity of 384 GW, has taken a big leap since 2010 when the total installed capacity was 159.3 GW. Total installed power capacity has jumped by 141.1% in the past 10 years. India's high energy demands are not going to ease out soon, and the country is planning to double down on the total installed power capacity in the country, aiming for a target of 750 GW by 2030.

Meanwhile, the South Asian economy is also committed to sustainable means of development and lower its carbon footprint & other harmful emissions through increased production of clean energy such as hydro, solar, wind, biomass, etc. By 2030, India plans to develop 450 GW of clean energy, comprising 60% of the total installed capacity.

While wind and solar energies have significantly extended their footprint backed by policy impetus in the last 10 years, overall growth in hydropower generation has slowed down, due to its capital-intensive nature. Generating 1 MW of hydropower requires an investment of USD 1.57 million. In comparison, the same volume of solar energy and wind energy will need initial average investments of USD 530,000 and USD 670,000 respectively.

Additionally, many times hydropower plants are situated in difficult terrains. This requires incremental cost in the form of infrastructure such as bridges, roadways, etc. to improve accessibility, which further increases the cost and undermines the financial viability.

Due to cost overrun many hydropower projects in India are currently stressed/ stuck. The current pipeline of hydropower projects in India is around 12 GW, out of which 4.2 GW is classified under the private sector. Around 2.7 GW of the private sector, projects are currently stuck due to various financial, topological, and environmental challenges.

Inherent Benefits of Hydro Power

Hydropower will continue to gain prominence in India's renewable energy roadmap, despite higher upfront costs due to numerous inherent benefits. The operational costs are low in hydropower generation. Its upstart time is quick, which makes it suitable during peak-load hours. The hydroelectric systems can be coherently integrated with other conventional sources of power generation to create an optimal mix.

Besides, India also has a tremendous amount of untapped hydropower capacity. It is estimated that the total hydropower capacity in India is close to 145 GW and it can generate around close to 87 GW of energy at a load rate of around 60%.

To further harness the power of hydroelectricity in the country, GOI has finetuned policies to make it more feasible and viable. In 2019, the government has notified to bring big hydropower plants in the purview of renewable energy to boost investments, facilitate green financing, and enable easier uptake.

New Hydro Power Policies of India

In 2019, the Indian government has notified a new hydropower policy to systematically leverage the country's vast hydroelectric capacity, provide an institutional framework for increased and seamless private sector participation and achieve targeted capacity development.

- In 2019, large hydropower plants have been awarded the status of renewable energy. This will be helpful for such projects to access green financing options.

- Energy distribution companies in India are either mandated to purchase a certain portion of renewable energy or buy renewable energy certificates. Following the government approval, now large hydropower can issue and sell non-solar Renewable Purchase Obligation (RPO) to distribution companies.

- Often complicated resettlement processes, additional infrastructure investments to improve accessibility, and flood moderations, etc result in cost overrun. This also adversely impacts tariffs. In turn, higher tariff dissuades distribution companies to purchase hydropower. In the new policy, the government has declared the share these incremental costs through budgetary allocation. Financial support of USD 200,000 will be provided for each 1 MW of energy produced up to 200 MW capacity. Thereafter the support will be pegged at USD 130,000.

- The government has also announced effective tariff rationalization policies. Power generators are now given the flexibility to decide their rates of tariffs. Likewise, the debt repayment period has been increased to 18 years from 12 years earlier. The cheaper tariff will help hydropower producers to compete better with other affordable forms of power such as solar and thermal, etc.

Small Hydro Power Will Compliment the Energy Mix

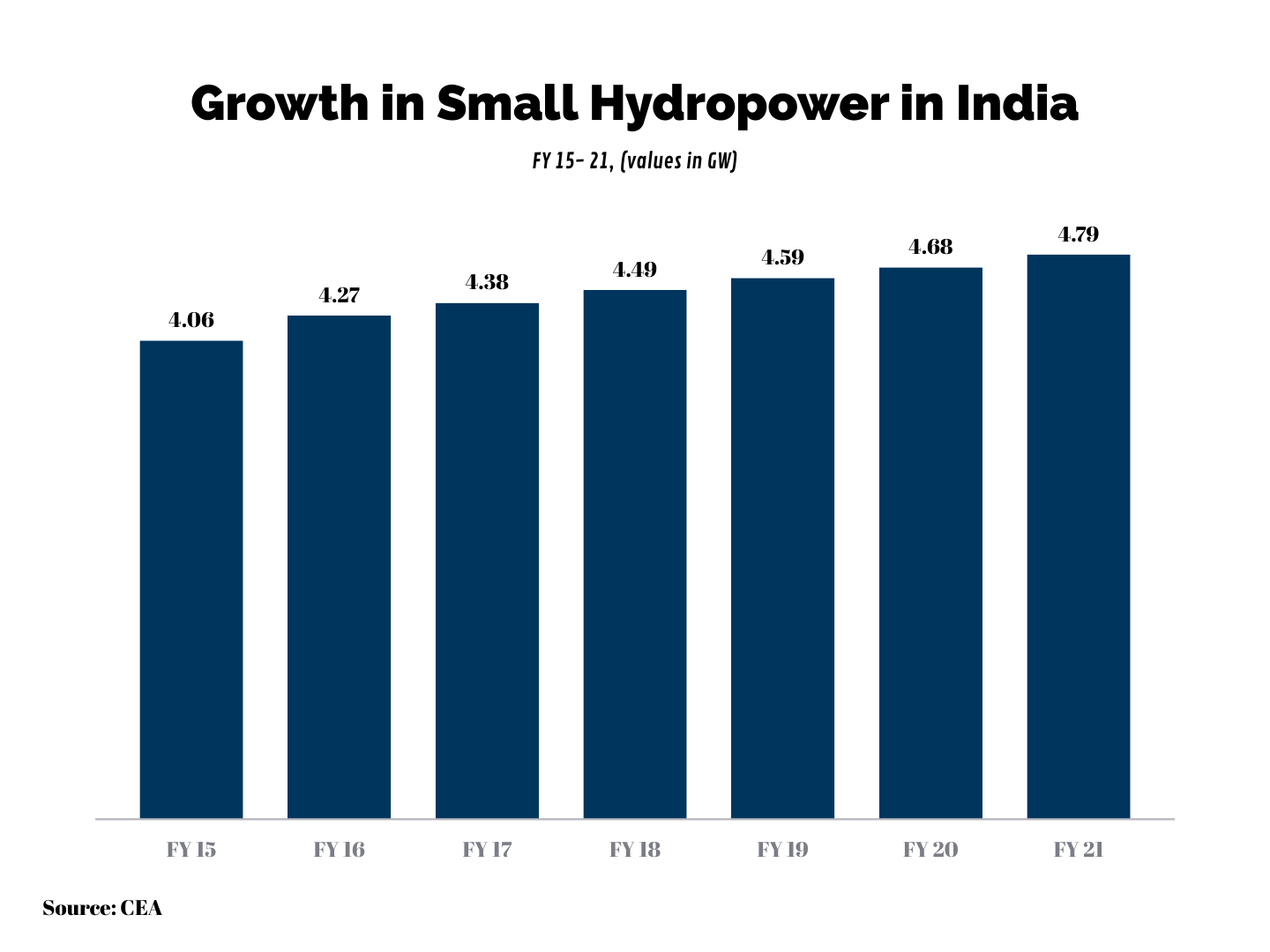

Over the past few years, India's small hydropower generation (<< 25MW>

Small hydro can complement big hydro and can be a potential tool to meet the growing energy demands of rural India. It can fulfill the household needs as well as support the small-scale industries thereby boosting the agrarian economy. The up-front cost of generating 1 MW of small hydropower in India ranges between USD .95 to 1.3 million and is lower than the larger peers. Small hydropower does not require dams and can be built across canals and run of the river. They are environmentally more feasible and do not require relocation and deforestation.