-

Your trusted market research partner

- info@theindiawatch.com

- 8076704267

The Future of Food Processing Industry in India- Opportunities & Threats Assessment

India's food processing & food retail industry is poised to grow at a vigorous pace. India is one of the largest producers of numerous food categories such as Dairy, Cereals, Fruits & Vegetables (F&V), Animal Proteins, Fishes, Spices, Tea, etc. This gives the South Asian economy a natural advantage in playing an extensive role in the global food supply chains.

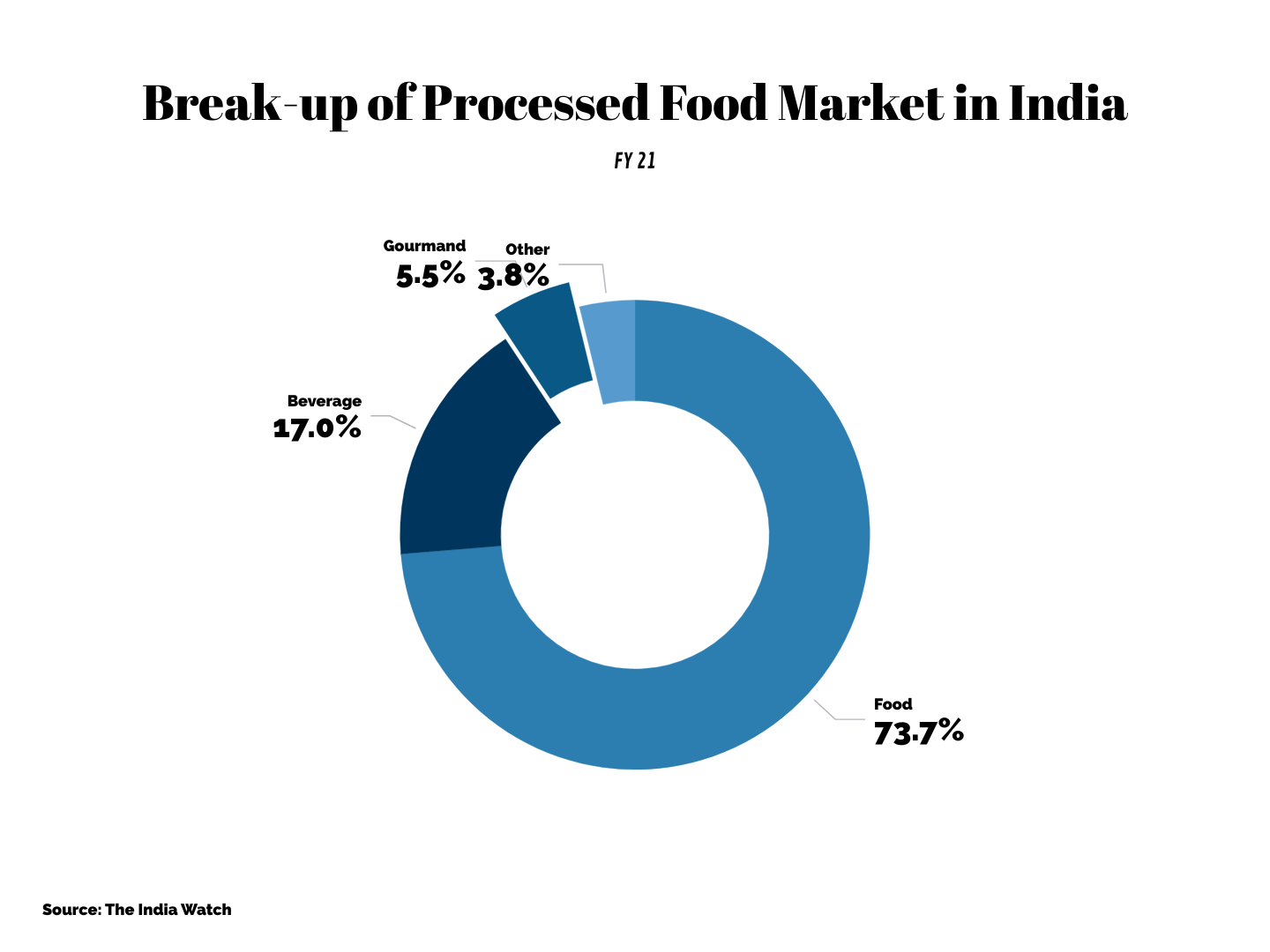

Hitherto, India's food processing industry has been underutilized, constituting around 1.5% of the global markets. In FY 2019, out of the total food and agri-commodity exports of USD 38.5 billion, processed food had a minority share of around USD 4.15 billion. In India's total food basket, sized at USD 294.5 billion, the share of processed food is just 32%.

There are numerous factors behind a suboptimal processed food sector in India. Besides limited investment in food-value addition industries and retail distribution, which is still highly unorganized (~ 85%), cultural factors are also accountable. In India, the emphasis has been more on eating freshly cooked food, thereby undermining the demand for processed edible items.

However, with the surge in the size of the Indian middle class, changing consumer preferences, and the rise of the women workforce, demand for processed food is rising. The steady growth in organized retail and a sharp rise in online retail will further push the industry in a positive growth trajectory. The government is also making big investments in the food processing and retail industry.

Opportunities

Agriculture Growth: Agriculture output will rise in India on the back of good Monsoon in recent years. The sector is expected to provide a cushion to the economy alongside fostering growth in exports. Even during the lockdown, agriculture activities were allowed, which has given resilience to the Indian agriculture industry and enabled it to largely absorb shockwaves. Growth in agriculture will naturally strengthen the backend of the food supplies and dovetail the industry towards a growth trajectory.

Limited Risk in the face of the Pandemic: COVID has a limited impact on the aggregate food demand, as food consumption remains mostly inelastic. Even in case of a future crisis, food demand would be largely unaffected. There may have been changed in the pattern of consumption, but the aggregate trends remain largely unaffected.

Food E-commerce will grow: The recent pandemic has resulted in an unprecedented shift in consumer preferences. As digital consumerism is on a rise in India, the demand for door-to-door online food delivery and grocery is on the upswing. Large horizontals ( Amazon, Flip Kart, etc.), verticals (Big Basket, Groffers, etc), Aggregators (Jio Mart), Food ordering apps (Zomato, Swiggy), Cloud Kitchens (Fresh Menu, Rebel Foods, etc) are aggressively extending their footprint. This will in turn offer strong impetus to the food processing industry in the country.

Global Food Production might Decline: Global food stocks are at a healthy level. However, the risk of a supply disruption can't be negated. Likewise, due to a shortage of animal feeds, fertilizers, & pesticides, the overall output might shrink in many parts of the world. Amidst supply disruptions, India might have to step up and fill the gaps.

Increased Branding: The extended lockdown following the crisis has given rise to the Youtube chefs, home chef culture in India. This will also drive growth for processed food going forward. Interestingly already demand in a slew of categories such as pasta, bakeries, sauces, Chinese items, etc. are on an upswing.

GOI Impetus: Despite large food resources at its disposal, the percentage of food processing is very low in India. In popular categories like F&V, meat, and dairy, the percentage of processing is 2%, 21%, and 35% respectively.

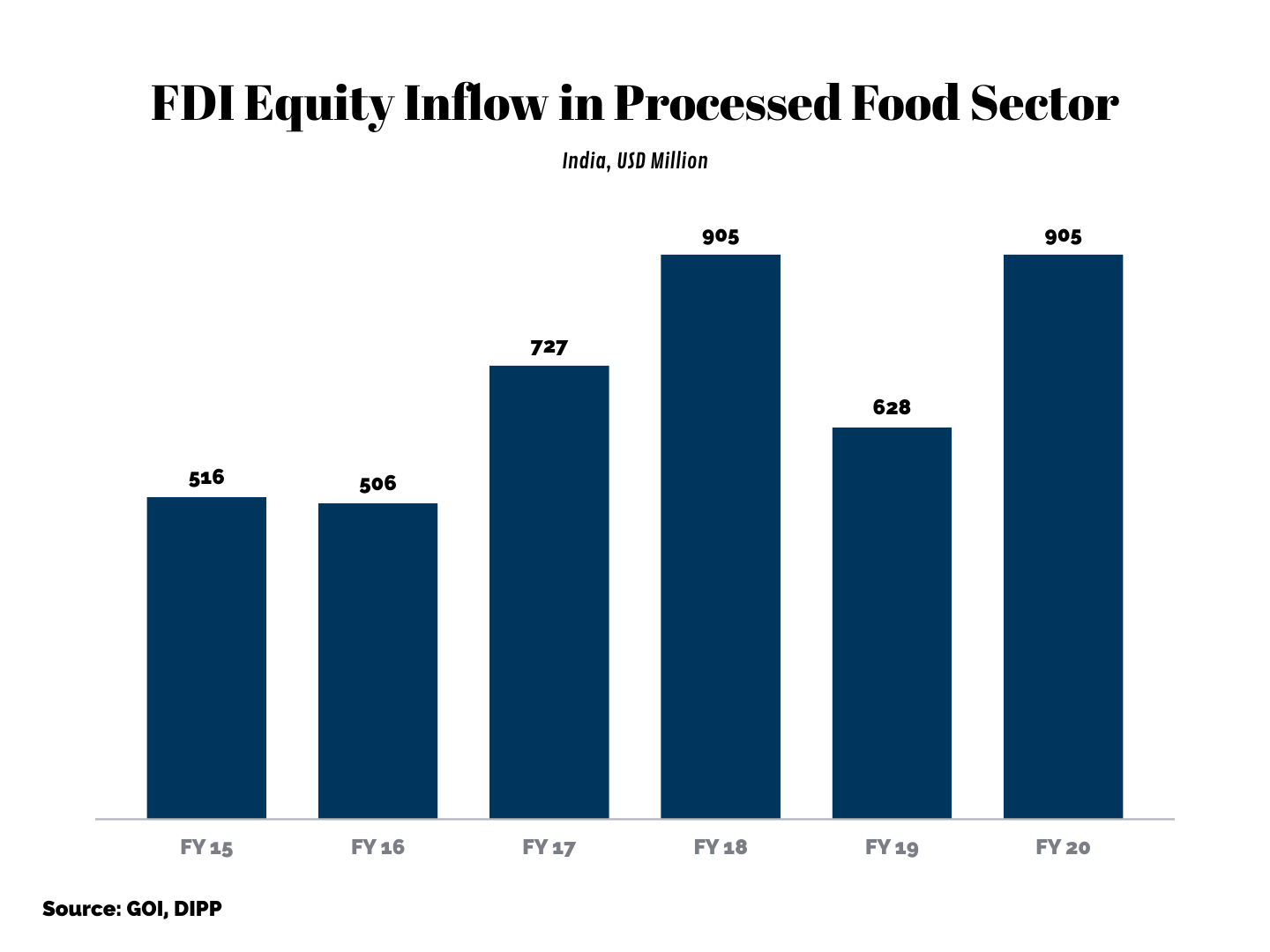

To reverse the current trend of lower processing volumes, GOI is offering multifaceted policy impetus and financial incentives to step up manufacturing facilities. 100?I has been allowed in the food processing industry to attract large volumes of capital and facilitate technology transfer. In FY 20, the FDI inflow in food processing was a little less than USD 1 billion, almost doubling in the last 5 years.

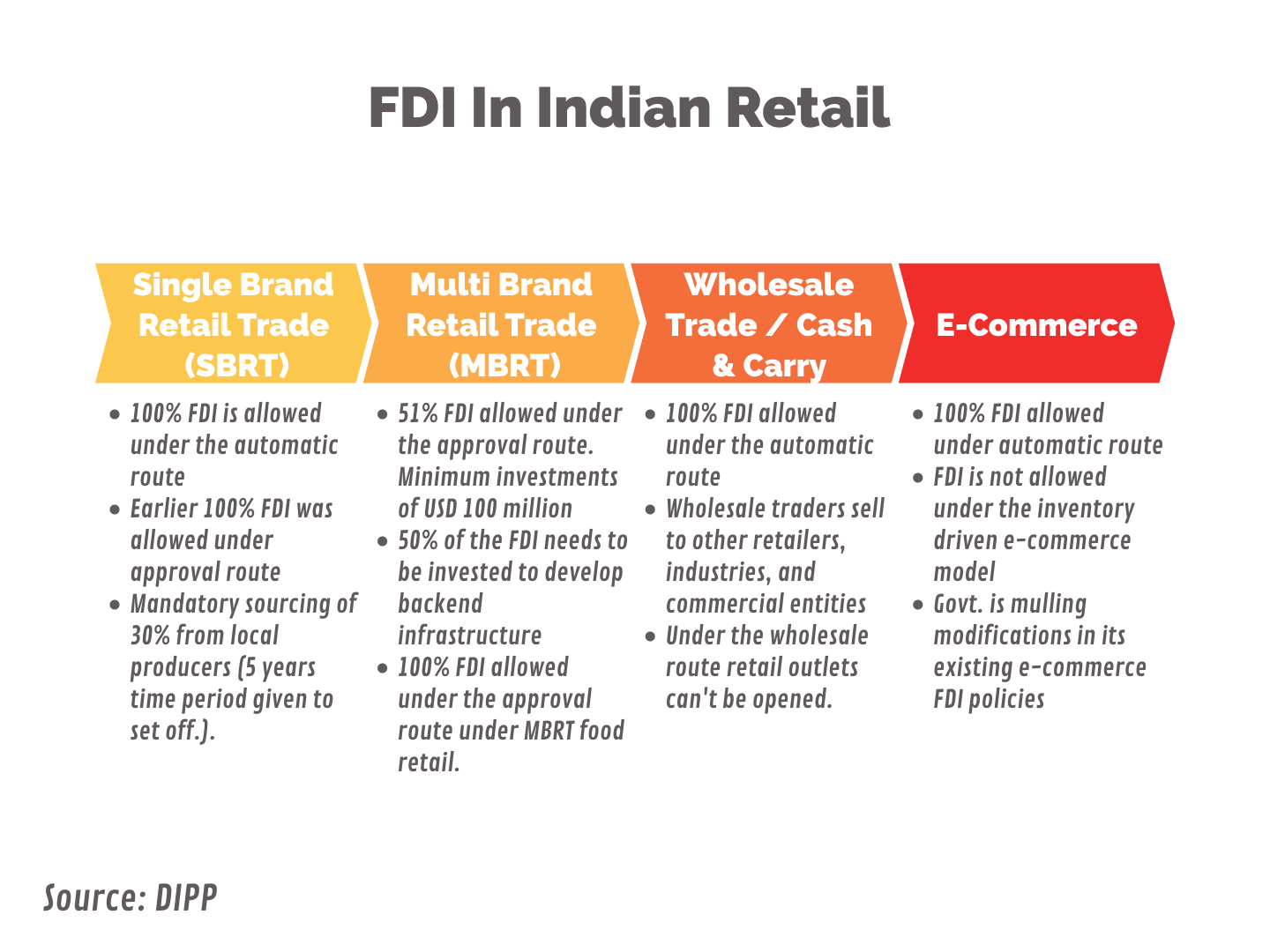

42 Mega parks have been announced, out of which work has begun in 17 already. Each food park will have 30-35 production units. To enhance the frontend supply systems, investments are made to develop new warehousing, cold storage, logistic supply systems. Simultaneously, the FDI policies in retail have been eased out to attract increased FDI in the organized retail industry. 100?I is allowed in SBRT, MBRT food retail (approval route), cash & carry, and e-commerce.

Threats

Heavy Losses in the F& B industry: The F&B industry including fine-dining restaurants, pubs, food outlets, etc is one of the major demand drivers of processed food in the country. The sector incurred heavy losses during the two phases of lockdown with virtually zero business. Although e-commerce activities are picking up, outside dining has come to a near halt. Even after the suspension of lockdown, people are avoiding eating out. Consequently, the losses in the F&B industry are not going to reverse soon and it will take 6-9 months to completely square off.

Nascent Industry: Despite being touted as a sunrise sector, the Indian food processing industry is still in its infancy. As discussed above, Indian constitutes just 1.5% of the overall processed supply. However, it also indicates that the market has huge potential to grow in the times to come. Favorable demographics, growth in disposable income, & evolving lifestyle will continue to fuel demand for processed food in India.

About The India Watch

The India Watch is an India-based market research & business intelligence platform. We offer customized research services to international & domestic companies to make informed business decisions. Food processing, food tech, & food retail are one of our key expertise. International & domestic food processing companies, food retail companies, food e-commerce start-ups, and other entities engaged in the food supply chain can avail of our tailor-made research & consulting services. Our research services include but are not limited to market/ industry overview, policy research, trend analysis, competition study, consumer behaviour, pricing & positioning insights, business model evaluation, & much more. Feel free to connect with us for all your research & information requirements by dropping us a mail at info@theindiawatch.com