-

Your trusted market research partner

- info@theindiawatch.com

- 8076704267

As Naphtha becomes a mainstream chemical, the market grows steadily

Naphtha serves numerous purposes. It is used in gasoline cracking, which makes a key element in India’s growing energy market. The petroleum and petrochemical industries are some of the major sources of Naphtha consumption. Besides Naphtha is also used as a solvent in paint, varnish, and soap industries. It is used as fuel in residential heating, cigarette lighters, and stoves. The chemical is widely used as a feed stock in the fertilizer industry as well.

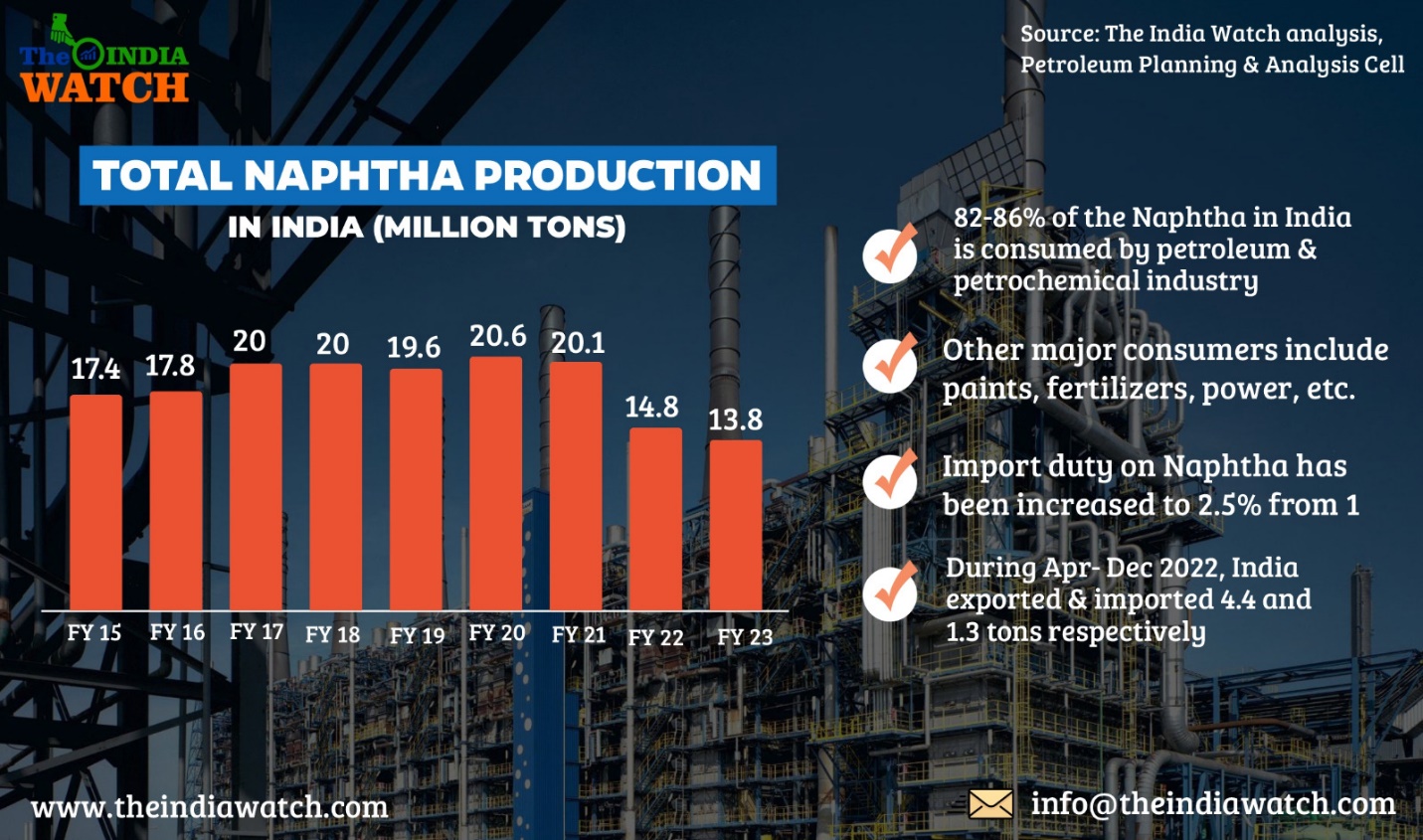

The major source of Naphtha production is petroleum refineries. In addition, they are also produced in the coal industry as well. In FY 23, the total domestic production of Naphtha amounted to 13.8 million tons.

India is slowly and gradually moving up the curve in the global Naphtha value chain. In Apr-Dec 2022, India exported 4.4 million of Naphtha worldwide. During the same time period, the South Asian economy imported 1.3 million tons of Naphtha.

As India aims to become self-reliant under the flagship of Make in India, there will be an increased focus on the chemical and petrochemical industry. As a mainstream chemical, Naphtha will be a party to increased government attention. The import duty on Naphtha has been increased to 2.5% from 1% to discourage import and bolster indigenous production. GOI wants most of the Naphtha used in India to be produced indigenously rather than relying on imports.

Factors driving the growth of Naphtha in India are as follows

- The Indian petroleum industry is on a strong footing, backed by an economic bounce back. Energy consumption in India has reached new highs after the economic recovery.

- In FY 23, Indian petroleum consumption reached 222.3 million tons, jumping by 10.2% from the previous fiscal. This is a marked difference from the slowdown caused during FY 21 and 22. As energy consumption and production is rising, Naphtha demand will also jump.

- India is an agrarian society with more than 40% of the population engaged in agriculture. This also entails growth in fertilizers consumption. Consequently, this will drive Naphtha demand as it is used as a feed stock in numerous fertilizers in India such as Ammonia and Urea.

- Naphtha is used as a feed stock in Indian petrochemical industries to produce Propylene, ethylene, etc. India’s expanding petrochemical footprint will entail increased demand for Naphtha. For instance, the current consumption of Propylene is annually over 6 million and is growing at a CAGR of 7-8%.

- Naphtha is used in numerous other industries as a solvent such as paints, soaps, varnishes, etc.

Presently the market is run by public-sector oil companies such as IOCL, GAIL, HPCL, etc. alongside some of the private sector companies such as Reliance Industries. However, looking at the steady pace at which, the demand is evolving, there is ample space for new players to enter the market. 100% FDI is allowed in the segment to further attract investments.