-

Your trusted market research partner

- info@theindiawatch.com

- 8076704267

FY 21-26: Airport Infrastructure Projects set to Receive Investment of USD 8.6 Billion

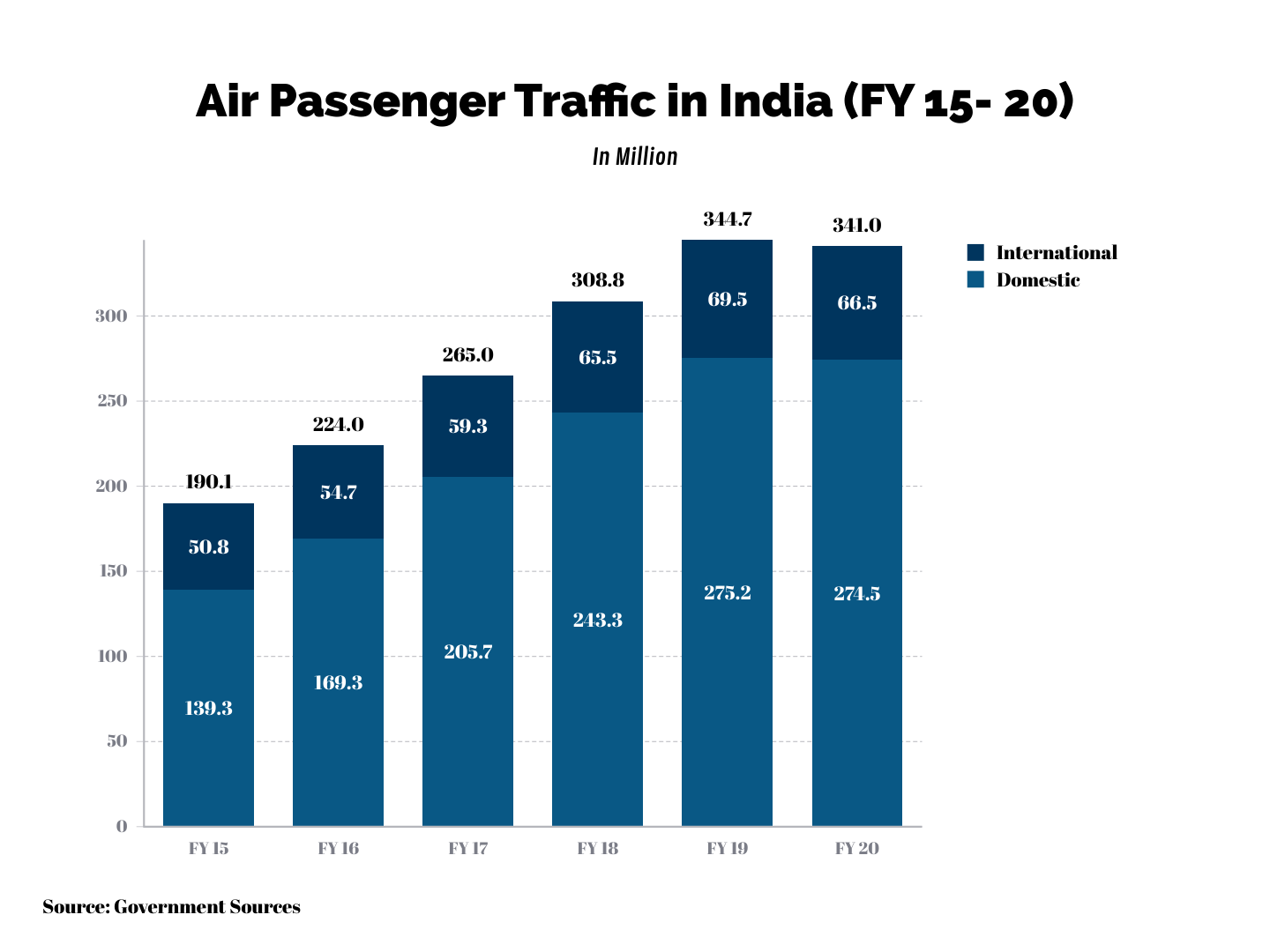

India is one of the fastest-growing aviation markets in the world. Limited penetration, growth in disposable income, and rising demand for faster commute have helped the industry to grow aggressively in recent years. From FY 15 to FY 20, the total annual passenger volume in India reached 341 million from 190.1 million, growing at a CAGR of 12.4%. During the period, domestic passenger volume grew by a CAGR of 14.5%. Meanwhile, the growth rate in international passengers was pegged at 5.5%.

Although the COVID-trigged crisis has flattened an otherwise bullish growth curve, the industry is set for a revival. The demand for corporate travel will be subdued in near future but growth in leisure travel will set the ground for recovery. Reduced cost of travel and demand for faster travel will continue to push the industry in India in a positive direction.

India's growing air travel market will entail increased investment in airport infrastructure. From FY 21 to 26, airport infrastructure investment projects will receive an investment of USD 8.6 billion, as per the research by India Watch. This will include greenfield projects (USD 4.03 Billion) and expansion projects (USD 4.55 Billion).

Policy Support for Airport Infrastructure in India

GOI understands the greater role aviation plays in the long-term sustainable growth of the economy. A robust aviation sector can help in the faster commute of passengers & goods, connect remote parts of the country, and significantly contribute to international trade & tourism. Hence, GOI has outlined favourable FDI & private sector participation policies, an exhaustive airport infrastructure improvement roadmap, and a program to enhance regional air connectivity.

- 100?I is allowed under the automatic route in both greenfield as well as brownfield airport projects. 49?I is allowed under automatic route in scheduled passenger airlines in India. Government approval is needed for above the 49% mark. 100?I is allowed under automatic route for non-scheduled airline services such as helicopter services & private air services. Likewise, 100?I is allowed under the automatic route for ancillary services such as maintenance & support, ground handling, repair & overhaul, etc.

- To boost regional connectivity, the government has announced the UDAN scheme in 2018. Under the scheme government will enhance the capabilities of smaller airports and underserved airstrips and coherently link them with bigger airports. So far a fund deployment to the tune of USD 610 million has been done. In 2018, the government also announced another ambitious project for the Aviation industry in India, namely NABH (NextGen Airports for Bharat). Under the flagship of NABH, the GOI will build 100 new greenfield airports in the next 15 years, apart from significantly improving the capacity of existing airports.

- Traditionally, AAI (Airport Authority of India) has been managing airports in India. Currently, there are 126 airports in the country managed by AAI. In recent years, GOI is systematically opening airports for more private sector participation under the PPP model. AAI now has a minority share in major Indian airports- Delhi, Bangalore, Mumbai, and Hyderabad. Recently stakes in six more airports- Mangalore, Trivandrum, Lucknow, Guwahati, Ahmedabad, and Jaipur have been sold to private players to manage, operate, and develop. Monetization of existing airports can raise fresh funds that can be redirected to greenfield projects.

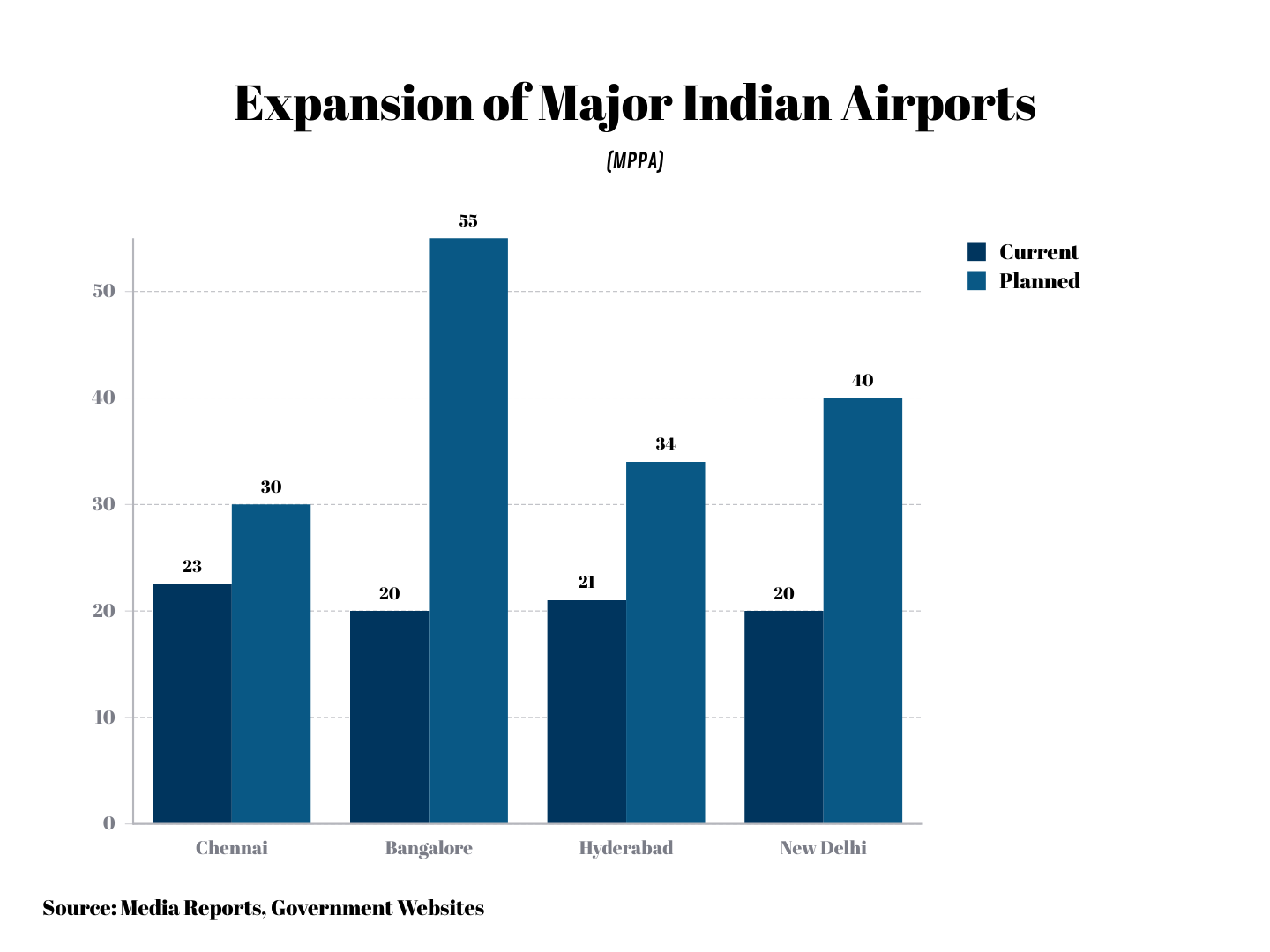

Expansion of Existing Airports in India

The Indira Gandhi International Airport in India is led by a consortium namely Delhi International Airport Limited (DIAL). GMR group holds a 54% stake in DIAL, followed by AAI which has a 26% stake. The remaining stake is equally split between Fraport and Malaysia Airport. DIAL is doubling the capacity of IGI to 40 MPPA following the opening of a new terminal. The new terminal, which is expected to be operationalized in 2026 will also make IGI the only airport in India with four terminals.

The Bangalore International Airport is set for an expansion with enhanced capabilities expected to reach 55 MPPA in the next 10 years. The airport, which is managed by Bangalore International Airport Limited (BIAL) is the first airport in India developed under a PPP model. Currently, GVK group holds the majority share (43%) in BIAL.

The Chennai Airport is set for a facelift that will be carried out in two stages. This will involve dismantling the existing domestic and international terminals to develop a large size integrated terminal. Following the expansion work, the airport is expected to receive an additional capacity of 7 MPPA. GHIAL (GMR Hyderabad International Airport Limited) has secured USD 300 million in funding for the expansion of the airport.

A new terminal is expected to be operationalized by the end of the current CY in Lucknow, which will improve the capacity to over 10 MPPAs from 5.9. The Guwahati airport in the North East region is also set to take a giant leap with a new terminal building that will enhance the capacity to more than 12 MPPAs.

Greenfield Airport Projects in India

From FY 21 to FY 26, work on 13 Greenfield projects will be underway, which will channelize an investment of USD 4.03 Billion. This will include Navi Mumbai, Jewar Airport, MOPA (Goa), Dholera, Gwalior, etc. These new projects will add 48.9 MPPA of capacity.

In Navi Mumbai, which is part of the greater Mumbai Metropolitan Region (MMR), work is in full swing in a greenfield airport project. The 1st phase of the airport with an investment of over USD 1.9 billion will have a capacity of 10 MPPA. Subsequently, the capacity will be increased in further phases. The airport is located at a distance of 35 Kms from the existing airport in Mumbai.

Land acquisition will shortly be begun for an international airport in the Jewar region, located at a distance of ~ 80 Kms from the IGI airport in New Delhi. An investment of USD 690 million will be made to develop the initial phase of the airport. Zurich Airport has been awarded the contract to build the airport. In total, the project is expected to cost around USD 4.1 billion.